Treasury retires $1Bn of 2028 Eurobond ahead of schedule with new loan

National Treasury PS Dr. Chris Kiptoo

Kenya's mounting debt obligations continue to be a hard nut to crack for policymakers at the National Treasury. In the latest move by the Treasury to navigate the country out of default, Kenya has secured a $1.5 billion (about Sh193.8 billion) loan from investors in the global financial markets to pay off a Eurobond that is maturing in 2028.

According to the Treasury, this move three years to the maturity would ensure that the government cuts borrowing costs, offer a sigh of relief to taxpayers, and strategically cushion the economy from shocks.

The $1.5 new loan is split into two; a seven-year facility that has been secured at 7.875 percent and a 12-year loan that will be repaid at 8.8 percent.

“This transaction shows the Government’s firm commitment to managing debt more wisely, paying off loans on time, and protecting Kenyans from sudden repayment shocks,” an update signed by Treasury Principal Secretary Dr. Chris Kiptoo stated in part.

The National Treasury added that the new loan has already been channeled to pay off $1 billion of the 2028 Eurobond.

The PS explained that repaying the 2028 debt not only avoids higher interest costs in the future but also gives the country much needed legroom to spread out repayments over a number of years.

“By securing this deal, the Government has also smoothened and lengthened loan repayments, giving Kenya more breathing space in managing its finances,” Dr. Kiptoo noted.

The latest issuance, which follows a similar move undertaken in 2024 to settle another Eurobond, saw the government receive $7.5 billion offers from investors yet the country sought just $1.5 billion. “The strong response shows renewed confidence in Kenya’s economy,” Dr. Kiptoo noted.

The Treasury said the funds will also help keep the economy stable while creating room to support development in key areas such as roads, healthcare, and education.

“This success means Kenya will spend less on interest, ease pressure on taxpayers, and keep the economy stable while creating room to fund development priorities such as roads, health, and education,” Dr. Kiptoo said.

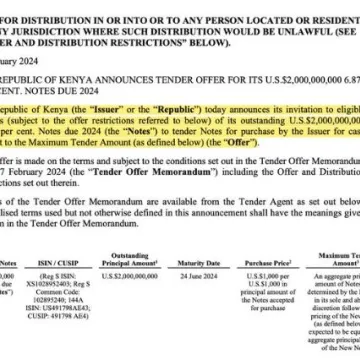

In February last year, the National Treasury undertook its first sovereign buyback of $1.5 billion to partially refinance the $2 billion, 10-year Eurobond secured in 2014, and which paid interest at 6.875 percent per year.