Kenya moves to buy back $2bn Eurobonds

Kenya moves to buy back $2bn Eurobonds

Kenya has embarked on a move to repurchase its $2 billion Eurobonds, which are set to mature in June, signaling a significant financial maneuver amidst favorable global financial market conditions.

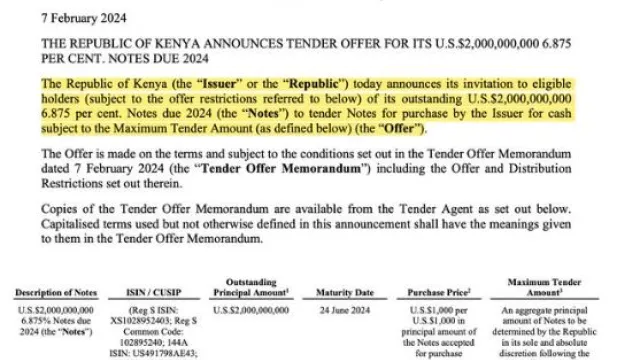

The government announced the initiation of this process, inviting eligible holders of its outstanding 6.87 percent notes due in 2024 to participate in the buyback offer, which spans a week and ends on February 14.

The decision to repurchase the Eurobonds comes at a time when yields on the papers have experienced a notable decline, currently resting at about 10 percent, down from previous levels that were twice as high.

This advantageous shift in yield rates has provided Kenya with a ripe opportunity to execute its buyback strategy, a plan initially revealed by President William Ruto in December 2023.

Under this plan, Kenya intends to acquire the notes and settle the accrued interest on the ten-year debt, thereby alleviating concerns surrounding its ability to service the looming maturity.

Dr. Kamau Thugge, the governor of the Central Bank of Kenya (CBK), underscored the positive global debt environment, citing it as a conducive backdrop for Kenya's re-entry into the global financial markets to refinance the maturing Eurobond.

Read also: High-interest rate regime sees Kenya shift financing strategy

Navigating the debt market

Dr Thugge noted recent successful bond issuances by other African economies, such as Cote D'Ivoire and Benin, which raised significant capital, further bolsters Kenya's confidence in its ability to navigate the debt market effectively this year.

However, delays in executing the repurchase plan had sparked apprehension regarding Kenya's fiscal resilience, particularly amidst challenges posed by rising inflation, declining forex reserves, and tanking domestic revenue collection.

In response to these economic pressures, the CBK on Tuesday hit borrowers by increasing its benchmark rate to 13 percent, the highest level of key loan rate last experienced in September 2012.

Policymakers at CBK aim to curb inflationary pressures and stabilize the Kenyan Shilling, which sustained a notable depreciation of approximately 27 percent over the past year, alongside dwindling foreign exchange reserves.

The $2 billion Eurobonds, initially issued in 2014, marked Kenya's foray into the commercial debt arena to address budgetary deficits. Despite being the largest external debt undertaken by Kenya at the time, the decision reflected a strategic approach to diversify funding sources and stimulate economic growth.

By capitalizing on favorable yield trends and leveraging global debt market conditions, Kenya aims to secure its fiscal stability and ensure sustainable economic progress in the face of prevailing economic challenges.