Safaricom locks in second Sh15Bn loan to drive green growth

Safaricom locks in second Sh15Bn loan to drive green growth

Safaricom's push towards its ESG agenda has received another KES15 billion Sustainability Linked Loan, bringing the total amount of credit secured to KES30 billion. Last year, the telco announced the receipt of a similar amount from a consortium of lenders: KCB, Absa Bank Kenya, Standard Chartered, and Stanbic Bank.

The company said the KES15 billion loan will help accelerate the firm's transition into a fully-fledged technology company as it aggressively seeks to cut its carbon footprint. Also under focus is the firms agenda on gender diversity as well as impact on the society.

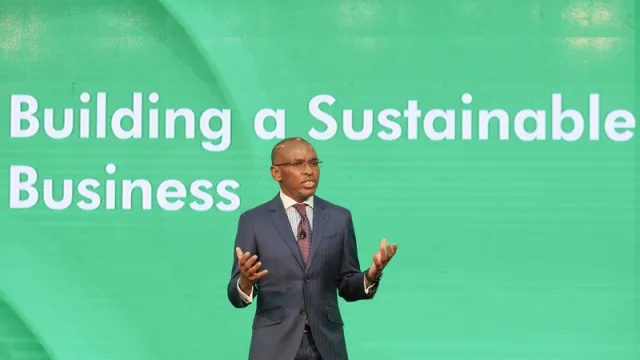

“This deal helps to accelerate the advancement of our sustainability agenda. It is a testament that we have achieved the targets we set out to achieve with the first one where we aligned our sustainability agenda with our financial strategy,” said Peter Ndegwa, CEO, Safaricom.

Safaricom, which plans to be a Net Zero carbon emitting company by 2050, has outlined a number of programmes to fast-track its ESG agenda.

Read also: Absa case study: Partnerships bank quick wins for the sustainability fight

“We have tapped into partnerships with key lenders in the region in the latest chapter of sustainability financing. It will improve our accountability measures on ESG reporting where we will have an opportunity to attract more investment and growth,” added Mr Ndegwa.

“Safaricom is dedicated to making conscious efforts to ensure that our projects and initiatives align with the ESG agenda. This deal highlights our commitment to sustainability and the inherent alignment of our sustainability and financing strategies,” added Dilip Pal, CFO, Safaricom.

In the financing deal, Standard Chartered continues to act as Mandated Lead Arranger and Bookrunner, Global Coordinator and Sustainability Coordinator for the transaction. At the same time, KCB acted as Mandated Lead Arranger, as well as Stanbic Bank Kenya and Absa Bank Kenya who both acted as arrangers.