New e-platform poised to offer students vital lessons on money

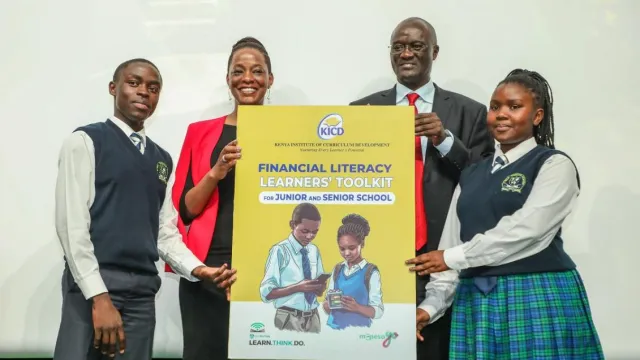

Esther Masese Waititu, Safaricom’s Chief Financial Services Officer, and Arthur Oginga, Old Mutual CEO, pose with M-Pesa Foundation Academy students Stafford Shikwekwe and Lillian Peggy during the launch of an innovative book and financial literacy program.

A partnership between M-PESA GO, financial services Group Old Mutual, and the Kenya Institute of Curriculum Development has unveiled an online financial literacy platform that seeks to impart knowledge to students.

The toolkit, which is modeled for learners in both junior and senior schools, comes after the launch of a teachers’ training platform in June this year that sought to empower teachers with the necessary skills, enabling them to shape the minds of young ones.

The program is downloadable from M-PESA Go and Old Mutual websites and has sessions and gamified digital experiences that will enable students to learn directly from industry experts.

Safaricom PLC Chief Financial Services Officer Esther Waititu noted that Kenya’s financial ecosystem has transformed in the last decade to include a wider range of financial services and digital finance enabling any time anywhere access and making financial literacy a pillar of a financially healthy society.

“Kenya has a youthful population, which means young people play a major role in economic growth now and in the future. As such it is important to build their financial capabilities. And this requires a concerted effort from the public, private, and social sectors.”

“Financial literacy is essential to financial stability, which is one of our main objectives,” added Waititu.

Read also: Banking in the eyes of the Next Generation Consumer

Financial health

“The younger people acquire financial health, the more likely they are to make sound decisions about money. They are more likely to save for a rainy day, to invest wisely, to borrow judiciously when necessary. And they are less likely to fall prey to fraud or predatory practices. M-PESA Go, offers young people aged 13 -17 years a platform to save, make transactions, and practice financial wellness at a young age for a money-smart generation.”

Old Mutual Group CEO Arthur Oginga underscored the need for players in the financial services industry to nurture a healthy relationship between young people and money.

Financial resilience

The industry also needs to promote financial resilience and cultivate financial wellness among Kenya's young people.

"Without proper preparation, we risk perpetuating a cycle of instability for the next generations. By prioritizing financial education, we will empower these young individuals to develop sound financial habits that will serve them throughout their lives," noted Oginga.

“By prioritizing financial education, we will empower our young learners to develop sound financial habits that will serve them throughout their lives. This is why we are investing resources to support integration of financial education across curricula,” he added.

The toolkit was developed in response to the need to mainstream financial literacy education through the current school curricula.