Equity, IFC alliance launches $20M refugee financing initiative

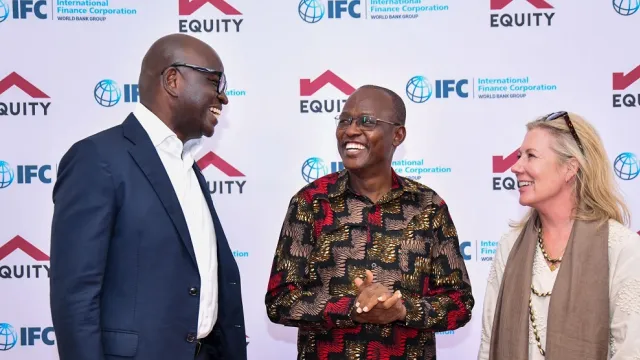

From L: Equity Bank MD Moses Nyabanda, Turkana County Governor Jeremiah Lomorukai and IFC Regional Director for Eastern Africa Mary Peschka, during the launch of a $20 million Risk-Sharing Facility (RSF) for Refugees and host communities.

Equity Bank and the International Finance Corporation (IFC) have partnered to launch a $20 million Risk Sharing Facility to boost financial inclusion for underserved areas, including refugees and host communities, in 14 counties across Kenya.

This initiative aims to empower refugees and host communities to become economically stable and self-reliant making them active participants in the local economy, contributing to sustainable development and long-term prosperity.

The program, unveiled in Kakuma, Turkana County also targets Garissa County, which host Kakuma and Dadaab refugee camps, with the goal of supporting refugees and their host communities towards social economic empowerment that ultimately lead to self-reliance.

This is the first global risk-sharing facility dedicated to financial inclusion for refugees and their host communities.

“The Risk Sharing Facility (RSF) program is a crucial component of our Africa Recovery and Resilience Plan (ARRP), as it directly addresses the financial needs of vulnerable populations and fosters entrepreneurship, ultimately creating jobs and building more resilient communities," noted Equity Bank Kenya Managing Director, Moses Nyabanda.

He added, "By expanding access to credit and other financial services, we are investing in the future of refugees and host communities unlocking opportunities to transform their lives, give dignity and expand opportunities for wealth creation."

Mary Porter Peschka, IFC's Regional Director for Eastern Africa, expressed her confidence in the partnership, stating: “This facility is helping to unlock the entrepreneurial potential of refugees and their host communities, creating jobs, providing services, and driving development in the region.”

The RSF program will enhance Equity Bank’s unsecured microlending proposition, focusing on character and capacity to pay rather than collateral. The program will initially provide access to financial services for marginalized communities.

Non-financial services, such as financial literacy training and agribusiness capacity building, will also be offered through a partnership with the Equity Group Foundation.

With a significant portion of micro, small, and medium enterprises (MSMEs) in Kenya lacking access to vital financial services – studies show unmet demand for finance as high as 83% – this initiative has the potential to unlock substantial economic growth.

The program aligns with ARRP's goal of creating five million businesses and 25 million jobs by 2030. Given that only 56 percent of Kenyan MSMEs are formally registered, and a further 73 percent of those registered reported being underserved in previous studies, the RSF program has significant potential to expand financial inclusion and drive economic development.

Turkana County Governor Jeremiah Lomorukai Napotikan, welcomed the initiative, stating, “By assuming 50 percent of the risk exposure, the IFC has reaffirmed its commitment to innovative financial solutions that prioritize the most vulnerable. This shared-risk approach empowers Equity Bank and other financial institutions to extend credit to businesses that might otherwise be excluded from the financial system."