Why farmers are not going for loans

Why farmers are not going for loans

About 76 percent of farmers, who depend on rainfall, were reluctant to get bank loans due to fear of crop failure despite experiencing higher costs of inputs in March 2024 compared to January.

The Central Bank's March 2024 Agricultural survey shows that farmers reported incurring significant costs in buying inputs such as fertilizers and seeds as well as paying for labour.

The regulator's January survey equally reported a high share of growers shunning loans with high interest rates reported as the biggest barrier to accessing credit.

During its meeting on April 3, the Monetary Policy Committee (MPC) retained the Central Bank Rate (CBR) at 13 percent, noting that its previous measures have lowered inflation, addressed the exchange rate pressures, and anchored inflationary expectations.

For farmers who use irrigation systems, their reluctance to access credit was attributed to significant price swings of their produce in the market, a factor that often makes their incomes unstable even during periods of bumper harvest.

"Some farmers also cited lack of collateral as a deterrent to seeking loans, especially in cases where farmers were leased," the survey reads in part.

The share of farmers who reported to have used the Hustler Fund increased in March 2024, partly due to the lower interest rate charged on borrowers by the government-backed platform.

Other digital platforms such as M-PESA, KCB M-PESA, and overdraft facility Fuliza were big drivers of credit uptake during the period under survey.

Read also: Agriculture funding in Africa is ripe for innovation

AFC loans dip

The CBK survey shows farmers accessing loans from the Agricultural Finance Corporation (AFC) in March 2024 were less than half of those who applied for credit from the parastatal in January.

At the same time, Savings and Credit Cooperative Societies (SACCOS) recorded fewer loan requests in March relative to January. A similar experience was reported by MicroFinance Institutions.

In contrast, cooperatives, who are buyers of farm produce such as coffee and milk reported higher requests for credit from farmers in March. CBK survey also revealed that a significant number of farmers went for informal money lenders, doubling the number of loan applications in March relative to January this year.

Overall, optimism from about 247 respondents in the survey about the expected performance of Kenya's economy remains high both in the next quarter and one year ahead.

"This is explained by several factors including the recent appreciation of Kenya shilling against the US dollar; realized and expected continued good performance of the agriculture sector, and a downward adjustment in fuel prices by EPRA in mid-December 2023, January, February, and March, 2024," the survey adds.

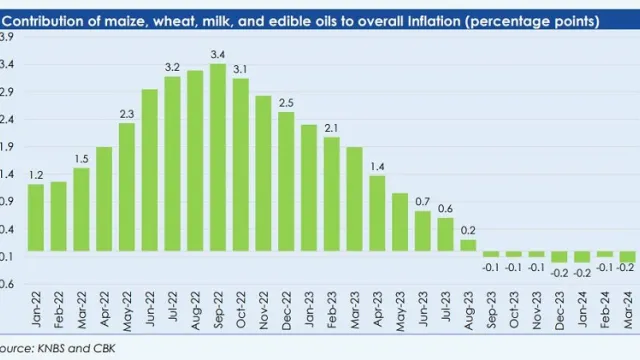

In Kenya, food inflation has moderated due to declines in prices of key non-vegetable food items particularly maize and wheat products, reflecting improved supply due to favourable weather patterns in the last year.

The survey drew respondents from wholesale traders, retailers, and farmers in select regions across the country, including Nairobi and neighbouring counties of Kiambu, Kajiado, and Machakos; Naivasha area, Gilgil Nakuru, Narok, Bomet, Kericho Kisumu, Mombasa, Kisii, Eldoret, Kitale, Nyandarua, Nyahururu, Mwea, Machakos, Isebania, Meru, Nyeri, Isiolo, Oloitoktok, Namanga, Makueni and Molo.