Lenders bank on rate cap to finish year on a high

Lenders bank on rate cap to finish year on a high

Lenders have become more efficient in managing cost and enforcing bad loans which has seen the Kenyan banking industry reap big in the first six months. Read also:

- Stanbic Bank posts impressive profits strong cash flows

- Shelter Afrique to stop lending directly to projects

Despite the Central Bank lowering the benchmark rate twice, in March from 10 percent to 9.5 percent and again last month to 9 percent bringing the cost of credit to 13 percent, banks still made decent profits.

KCB Group netted a profit growth of 18 percent to post after-tax profits of Sh12.1 billion for the first six months of 2018 from Sh10.2 billion in a similar period last year.

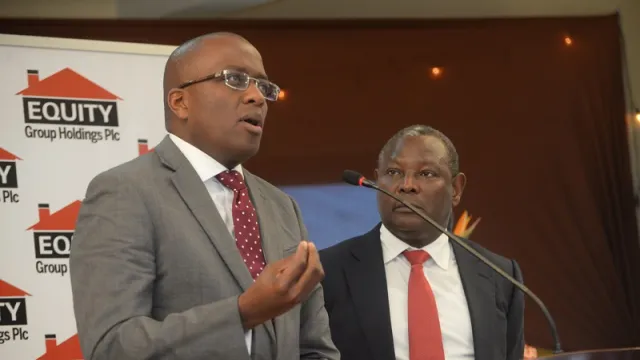

Equity Bank’s net profit jumped 17 percent to Sh11 billion in the first six months of 2018 an increase from Sh9.4 billion that the lender made in the first half of 2017.

Cooperative Bank reported a profit after tax of Sh7.1 Billion a 7.6 percent rise from the Sh6.6 Billion in the similar period the previous year.

Barclays Bank posted a 6.2 percent growth in net profit for the six months to June - Sh3.76 billion from Sh3.54 billion.

Stanbic Bank reported a 101 percent rise in net profits for the half year to June was Sh3.4 billion from Sh1.72 billion in a similar period last year.

The Banking sector hopes that the rate cap will be lifted next month giving banks a whole quarter to adjust rates to perceived risk which will allow them to lend more and capitalize to end the year on a high.

Removal of the rate cap is however largely dependent on Members of Parliament who are also borrowers and the government’s commitment to the International Monetary Fund conditions in order to access Sh150 billion insurance facility.

Risks are abound on the States commitment following reports that Mbui Wagacha, an economist, and adviser in the executive office of the presidency, termed the IMF’s recommendations on Kenya’s economic policies as being out of touch with local reality.