Kenyans abroad will send more dollars if Govt kicks out cons

Kenyans abroad will send more dollars if Govt kicks out cons

Kenyans in diaspora say fraud is their biggest concern when investing back home and want the government to develop solutions to weed out cons and aid in recovering their funds to unlock investment.

Kenyans living and working in foreign countries have often expressed their concerns sending money home which can turn into a nightmare if they send it to the wrong recipient.

Some are also often lured into cons by investors back home, who collect their funds for non-existent real estate projects and unlicensed financial products.

The Kenya Diaspora Alliance Chairperson Dr Shem Ochuodho said the government should put in place institutions and systems that will protect diaspora businesses in the country and also formulate recovery mechanisms that will aid them in recovering their funds quickly and efficiently in the event of fraud.

“Through their resources in remittances and pension fund investments, Kenyans abroad play a crucial role in investments, sustaining livelihoods and social services, as well as contributing to development initiatives through their expertise, networks, and social capital,” said Dr Ochuodho.

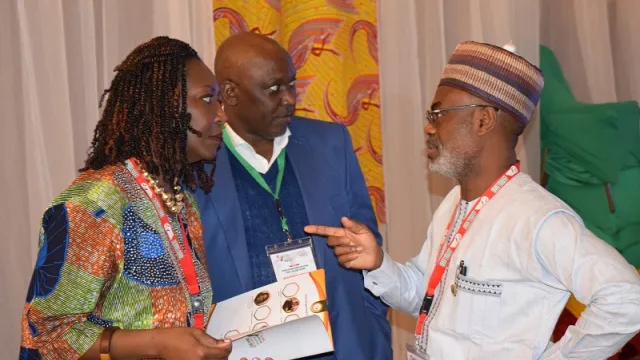

Dr Ochuodho’s was speaking at the Kenya Diapora Alliance leadership last week attended the Global African Diaspora Symposium (GADS) Abuja 2023 organised by the African Diaspora Alliance (AfDA) with the Organisation of African, Caribbean and Pacific States (OACPS) in conjunction with the Nigerians in Diaspora Commission (NiDCOM) and the Directorate of Technical Cooperation in Africa (DTCA), both of the Nigerian Ministry of Foreign Affairs, and the Federal Government of Nigeria.

The symposium was held to facilitate a consultative, interaction between African diaspora and other stakeholders where workable solutions to Africa’s most pressing issues were discussed and concrete strategies proffered for necessary partnerships between key diaspora leaders in business and professions with leaders on the African continent to achieve successful results.

Read also: Saudi Arabia overtakes UK as Kenya’s second leading dollar source

The meeting comes in the wake of data on diaspora remittance by the Central Bank of Kenya (CBK) indicating that cash sent home by Kenyans living and working abroad in the three months to March fell for the first time since 2010 as inflation hit multi-decade highs in many countries, squeezing household budgets.

Remittances dropped to $1.016 billion (Kes137.4 billion) in the quarter to March from $1.024 billion (Kes138.5 billion) in the same period last year.

Kenyans abroad typically send money to help their families and to invest in projects like real estate, with flow from the US accounting for about 60 percent of the total remittances.

The rising cost of living in countries like the US and in Europe on the back of costly energy, food and rent has been squeezing households and putting pressure on policymakers to bring the issue under control.

Dr Ochuodho has also announced that his led organisation is among global diaspora lobbies seeking to explore opportunities that abound on the continent for the African diaspora to structure and jointly execute projects and programmes with African Governments and the Private sector in Public Private People Partnership (PPPP) arrangements, which are being fully exploited by others like the Chinese, Indians, Lebanese and Americans.

“There are numerous investment opportunities within the Regional Economic Blocs, as well as country investment programs, to engage with the Diaspora for impact in African countries as the African Diaspora,” noted Dr Ochuodho.