Kenya’s path to fiscal health post finance bill veto

Kenya’s path to fiscal health post finance bill veto

A series of austerity measures, tax reforms as well as accountability strategies will be critical in steering Kenya out of the current fiscal challenges post the rejection of Finance Bill 2024.

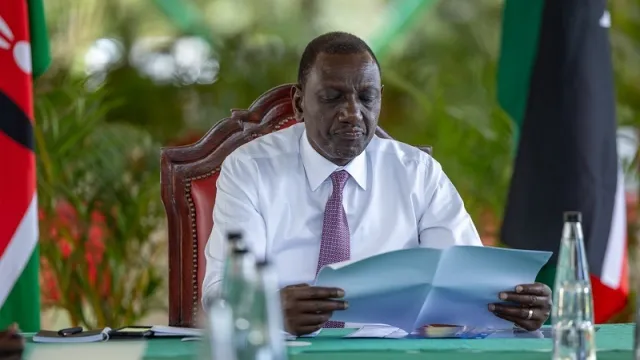

According to the Institute of Certified Public Accountants of Kenya (ICPAK), the government can explore several strategies aimed at managing expenditure following President William Ruto’s rejection of Finance Bill 2024, a move that will see the government starved of roughly Kes346 billion in the FY2024/25.

Rejection of the bill comes amid heightened public discontent and widespread protests against the burdensome tax measures in the face of the increasing cost of living in the country.

In a statement dated June 28, ICPAK acknowledges the underlying frustrations that fueled protests, which left about 22 people dead, part of parliament torched, and rural homes of some legislators who supported the bill set on fire.

Sustainable economic strategy

The protests, largely led by the youth who have borne the brunt of joblessness, also led to huge business losses, highlighting the need for a responsive and sustainable economic strategy to steer the country from the current economic challenges.

ICPAK is now calling for the rollout of a predictable and stable tax environment, which the professional body of accountants says is critical for economic growth and business stability.

Among their key proposals is the immediate implementation of the National Tax Policy, which aims to curtail Kenya’s frequent changes to tax laws that often disrupt business operations while creating uncertainty across the industries.

Additionally, the institute supports President Ruto’s directive for immediate austerity measures and fiscal consolidation to help achieve a leaner budget and check ballooning government expenditure, which has historically outpaced revenue collection, further widening fiscal deficit.

To enhance fiscal responsibility, ICPAK urges adherence to the principles outlined in the Public Finance Management Act of 2012 which includes rigorous management of salaries and wages, eliminating ghost workers, and undertaking regular payroll audits.

"There is need to implement the resolutions of the Third National Wage Bill Conference that emphasized on the government’s commitment to achieving a wage bill to revenue ratio of not more than 35 percent by 2028," noted ICPAK.

Read also: Ruto declines to sign Finance Bill 2024

National job evaluation

Additionally, they propose a national job evaluation to streamline the public sector workforce, reduce redundancy, and promote efficiency in public service.

ICPAK also calls for a reduction in supplementary budgets, which it says get abused, further widening Kenya’s budget deficits. Further, ICPAK is calling for prioritizing the completion of ongoing projects with high returns on investment, rather than initiating new capital projects.

Other measures ICPAK sees as necessary are cutting expenditures in areas such as advertising, communication, hospitality, fuel, purchase of furniture, purchase of motor vehicles, refurbishments, and routine maintenance of public offices to free up resources for other pressing needs such as health, and education.

As part of measures to enhance service provision, ICPAK is asking the government to consider unbundling functions to eliminate ongoing duplications between national and county governments, thereby optimizing resource allocation.

Addressing the over-reliance on a small pool of taxpayers, ICPAK points out that only a fraction of the economically active population contributes to income tax. The lobby is calling for broadening the tax base to distribute the tax burden more equitably, in line with constitutional principles.

Revenue leakages and corruption

"Out of the economically active and working population of about 19.7 million people, only 32 percent are contributing to income tax, translating to about 15 percent of the total population. As such, the tax burden is not shared fairly," explained ICPAK.

Furthermore, ICPAK highlights the critical issue of revenue leakages and corruption. They propose stringent measures to seal these leakages, including reviewing penalties for tax evasion, leveraging technology for better integration of taxpayer information systems, and taking decisive action against corrupt officials.

"Revenue leakage is caused by various reasons such as complicated tax systems, discretionary power on exemptions, as well as a dampened morale to pay taxes occasioned by the culture of corruption," said ICPAK.

ICPAK also revisits contentious clauses from the previous Finance Act, such as the Housing Levy and the Social Health Insurance regulations, calling for their immediate review and revocation due to their adverse impact on disposable incomes and the cost of living.