Inside Equity's Sh678 billion regional stimulus plan

Inside Equity's Sh678 billion regional stimulus plan

Regional banking giant Equity Group has unveiled a Kes678 billion financing plan targeting investors in the private sector as it seeks to give rise to roughly 50 million jobs.

The plan will see businesses in food and agriculture, manufacturing, logistics, trade and investment, MSMEs, social and environmental sectors within Eastern and Central Africa market tap from the financing plan.

The Group plans to provide loans to five million MSMEs and 25 million individuals to stimulate the participation of the local community and population, with a bias to young people and women-owned enterprises.

In total, the lender's financing will be equivalent to two percent of the combined GDP of the region's six economies in which the Group operates.

The programme will be in the form of short-term overdrafts, medium-term loans, and long-term project credit lines as well as development financing.

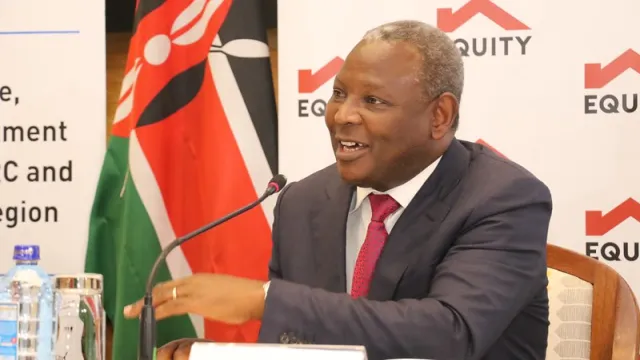

“The plan conceives that the five million businesses largely comprising MSMEs will create 50 million jobs, 25 million jobs directly and an equal number of jobs indirectly as the ecosystems of business become more cohesive, connected, and ultimately synergize and grow,” said Equity Group Managing Director and CEO, Dr James Mwangi, while unveiling the Recovery and Resilience Plan.

“The recovery plan will have special focus on youth and women, supporting them to be the primary drivers of creating and expanding opportunities in the real economy," added Dr Mwangi.

The young investors are further set to benefit through financial literacy, entrepreneurship training besides digital literacy skills programme.

Read also: Equity’s Till Number platform loops all digital wallets for merchants

Under food and agriculture, investors will get support to enhance value chain coordination, capacity building of smallholder farmers by anchoring them better to formal value chains, besides financing mechanization, and access to farm inputs.

The bank seeks to turn the region into a manufacturing hub that turns agricultural produce into finished products for both local markets and export.

Focus on trade and investments will see the expansion of markets for the primary sectors of food and agriculture as well as the finished products, along with the realization of investments to support the growth of the two sectors.

The East African Community, with the recent inclusion of the Democratic Republic of the Congo, will provide an expanded regional market.

“We seek to use our AAA+ rated finance brand to ensure the plan enhances its social contract with society by seeking partnership and collaboration with local communities to ensure their participation and involvement. The plan incorporates strong principles and practices to assure all stakeholders of transparency and openness, under ESG (Environmental Social Governance) considerations,” added Dr Mwangi.

Equity Group has already negotiated a collaboration with the United Nations Resident Coordinators in the six countries where it has presence for partnerships and participation of all the UN Agencies operating in the region for achievement of Sustainable Development Goals (SDGs).

The plan has already received the backing of governments of the six countries the Group operates in. Further, it has won the support and participation of IFC, AfDB, European Development Banks (Team Europe), the Commonwealth Secretariat, the African Continental Free Trade Area Agreement Secretariat, and the European Union.