Forget Robin-hood , reality has pushed the government to tax everyone.

Forget Robin-hood , reality has pushed the government to tax everyone.

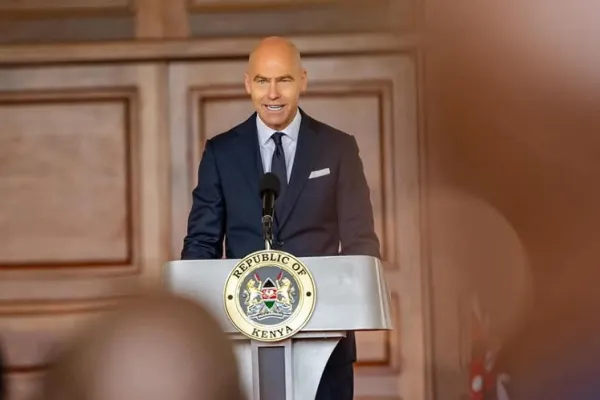

After making a pleasantly mwananchi budget where Finance Cabinet Secretary Henry Rotich sought to tax the rich to fund the government, reality has pushed the government to tax everyone.

The 0.05 Robin hood tax on transactions over Sh500,000 has been abandoned for a blanket excise tax on all transactions via banks and all financial institutions including Saccos and microfinance institutions. Read also:

The excise tax known as sin tax has been doubled from 10 percent to 20 percent and a similar charge has been put on all fees and commissions charged by the financial players.

While CS Rotich tried to push excise on mobile transactions from 10 percent to 12 percent, President Uhuru Kenyatta has not been too docile.

The cost of sending money through mobile services such as Safaricom’s M-Pesa and Airtel will increase further after President Kenyatta proposed to raise tax on the services to 20.0 percent.

Mr. Kenyatta is targeting products like mobile money services that are consumed by a vast majority of Kenyans in an attempt spread the burden of taxation

The proposed increase in mobile money tax aimed at boosting government’s revenue collection efforts will see M-Pesa users grapple with higher transaction costs going forward. The largely unbanked low-income segment of Kenya’s population that heavily relies on M-Pesa will be the most affected on the back of an uptick in the general cost of living.

ApexAfrica says that the proposed increase in mobile money tax aimed at boosting government’s revenue collection efforts will see M-Pesa users grapple with higher transaction costs going forward.

The largely unbanked low-income segment of Kenya’s population that heavily relies on M-Pesa will be the most affected on the back of an uptick in the general cost of living. Related: How digitization will continue to support bank growth in Kenya.

Telephone calls and data use are also about to be more expensive with the government charging a 15 percent excise duty charge.

Ecobank research had put East Africa as the most affordable mobile data with the average cost of downloading one gigabyte of data in Kenya at Sh335.

The lender said that Governments should introduce reasonable taxes on data usage which would grow as their citizens become more connected instead of making data use unreasonably expensive.

“The government must reduce heavy taxes on mobile data use, for instance, Uganda’s recently-introduced tax on social media Sh5 (UGSh200 per user per day) could deter those on lower incomes from accessing the Internet, retarding the digitalization process,” Ecobank said.

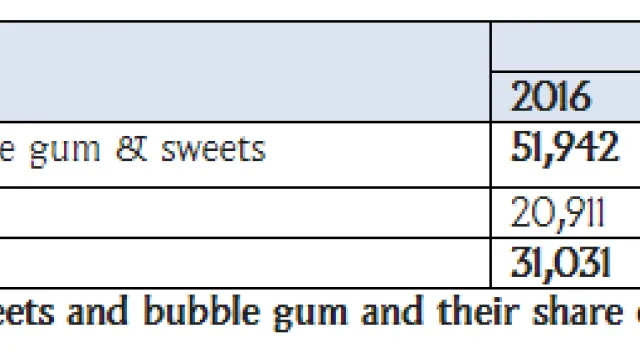

Children will be roped in with a sin tax on sweets, confectioneries, and chocolate which now attracts the Sh20 per kilogram tax.

Low-income households who use Kerosene will pay an additional Sh18 per liter in adulteration levy as well as a VAT of 8 percent on fuel.

Every formal worker will also foot the half a million housing project with a 1.5 percent deduction on salary and an equal contribution by their employers.

Failure to remit this 3 percent contribution by the 9 of every month will attract a 5 percent penalty.