Dip in incomes and high input costs hit NSE-listed firms hard

Dip in incomes and high input costs hit NSE-listed firms hard

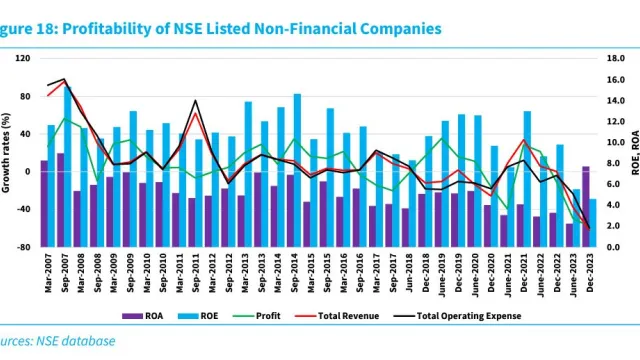

For a majority of Nairobi Securities Exchange-listed non-financial companies, 2023 was a year of reckoning. In the Central Bank of Kenya's Kenya's Financial Sector Stability Report 2023, these firms suffered a sharp 58 percent decrease in profitability.

Several factors—including reduced consumer purchasing power, soaring input costs, and supply chain woes—converged to erode the profits of these companies last year. According to the CBK, the downturn marked a reversal from the modest six percent profit growth recorded in 2022.

In 2023, the operating environment for listed companies was turbulent, with rising production costs outpacing revenues, the analysis by CBK shows. Consumers, struggling with shrinking incomes and purchasing power, scaled back their spending, directly affecting the revenue streams of many companies.

Compounding this problem were high energy costs and a depreciating exchange rate. Increasingly, this situation worsened the environment for the bulk of businesses that are dependent on imports for raw materials.

Read also: High inflation dims consumer optimism

Shilling depreciation

According to Cliffe Dekker Hofmeyr, the Kenyan Shilling lost roughly 22 percent in value to the US dollar between March 2022 and January 2024. A number of factors were to blame for the depreciation of the shilling including, the impact of Covid-19 pandemic economic fallout and tight fiscal policy by the US Federal Reserve.

At the same time, Kenya's economy was affected by the Russia-Ukraine war which choked global supply chains; the impact of the worst drought in 40 years; and a heavy heavy debt burden for East Africa's largest economy.

CBK survey observed that NSE-listed non-financial companies also grappled with competition from cheaper imported goods, fueled by global trade dynamics, further squeezing the profit margins of domestic firms.

Additionally, local companies found themselves saddled by inflated production costs. This, despite having to compete with lower-priced foreign-made products, creating a tough balancing act for local investors.

The CBK report underscores the scale of the profitability crisis during 2023, noting that firms faced tighter financial conditions, high taxes, and operational bottlenecks. The situation was exacerbated by a blend of external and internal shocks. These included the ripple effects of global economic slowdown and persistent domestic challenges such as high inflation.

While the number of profit warnings issued in 2023 dropped to nine from 13 in 2022, this reduction hardly masked the gravity of the financial stress facing businesses. The total was, however, below the record high of 18 profit warnings issued in 2015.

Some of the companies that issued profit warnings in 2023 included Limuru Tea PLC, Sanlam Kenya, Nation Media Group, Car & General, Kakuzi PLC, and Sasini PLC. Other firms that cautioned investors about profit slumps were: Crown Paints Kenya, WPP Scangroup, Sameer Africa, Express Kenya, Eveready East Africa, and Kenya Airways (KQ), the country’s national carrier.

Under the NSE rules, a company is required to issue a profit warning if its annual profit falls by at least 25 percent from the previous year’s amount. Profit warnings are a sign of financial distress and a warning to investors that the firm’s performance is deteriorating.

Read also: The tyranny of ‘King Dollar’

Impact of rising debt

The ongoing challenges facing NSE-listed companies have not only reduced profitability but have also pushed many firms deeper into debt, CBK noted. Declining revenues and strained liquidity have resulted in increased reliance on borrowing to keep firms afloat.

However, as debt levels rise, companies find themselves struggling to service their existing loans, thereby limiting their ability to secure new credit at better terms.

Looking ahead, the CBK report projects a resilient Kenyan economy in 2024 and 2025, but one that will grow below its potential due to several downside risks. These include high public debt, the effects of tightening global monetary policy, and liquidity constraints in both international and domestic financial markets.

Domestically, political uncertainty and ongoing governance reforms, taxes, and public spending issues are expected to slow growth in the latter half of 2024 and beyond.

Kenya's current narrow fiscal space and the government's limited ability to stimulate the economy could further constrain growth, warns CBK. Combined with lingering inflationary pressures, companies may continue to experience tough financial conditions in the coming years.