Consortium secures CAK nod for 51% stake in Monarch

Consortium secures CAK nod for 51% stake in Monarch

The Competition Authority of Kenya (CAK) has approved the proposed acquisition of 51 percent shareholding in Monarch Insurance by a consortium of three firms: Ondoba Ltd, Kenyoro Ltd and Equico Thirteen Ltd.

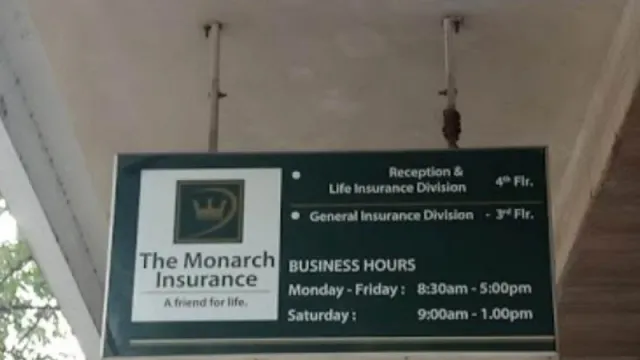

Monarch Insurance is a limited liability company incorporated in Kenya that provides cover, including general, motor solutions, and life.

“The proposed transaction involves acquisition of 51 percent of the total issued share capital and voting rights in Monarch by Equico, Ondoba and Kenyoro. The transaction therefore qualified as a merger within the meaning of section 2 and 41 of the Competition Act Cap.504,” CAK explained.

According to the disclosures, Kenyoro, Ondoba and Equico are companies in Kenya focused on investing in the financial sector. The parties said the rationale for the transaction is business growth and expansion by enhancing operational efficiencies and executing a strategy driven by partnerships from the new shareholders.

Read also: Why Travel Insurance is a lifesaver against the unforeseen pitfalls of travel

Additionally, CAK said it has determined that the acquisition will not affect the structure and concentration of Kenya’s insurance market as the entities will face competition from other players, who control a significant share.

“The proposed transaction is unlikely to lead to a substantial lessening of competition in the market for provision insurance services in Kenya.” said CAK, adding that there will be no employment loss since the proposed transaction involves the consortium making investments without altering its management functions.