Central Bank hits KCB hardest for stolen NYS cash

Central Bank hits KCB hardest for stolen NYS cash

Kenya Commercial Bank has been handed a hefty fine by the central bank for handling money stolen from the National Youth Service.

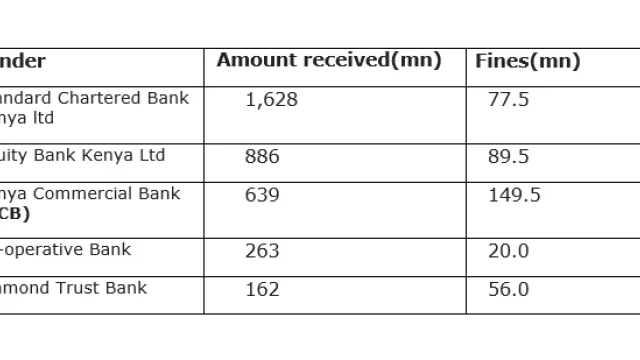

KCB will be required to pay Sh149.5 million for processing amounts of up to Sh639 million as CBK cracks the whip on rogue lenders. Read also:

The regulator has penalized KCB, Equity Bank, Standard Chartered Bank, Cooperative Bank, and Diamond Trust Bank a total of Sh392.5 million for their role on the Sh9 billion corruptions scandal, one of the country’s biggest scams.

Standard Chartered processed the most amount of cash at Sh1.62 billion but was fined Sh77.5 million while Equity Bank processed Sh886 million and was fined Sh89.5 million.

Co-operative Bank was transacted Sh263 million and will have to pay Sh20 million fine and Diamond Trust Bank will pay Sh56 million for transferring Sh162 5 million

At least six banks had been under investigations for their roles in processing the cash which was reportedly aided by banking insiders.

Some of the transactions more than Sh1 million were so huge they required lenders to report to Financial Reporting Centre (FRC) but the banks failed to do so.

Some funds were drawn over the counter with no documentation and others without due diligence that allowed the NYS companies to open accounts a few hours before the NYS money was credited.

Under the first Sh791 NYS scam, Family Bank suffered a beating when it emerged some of its staff were involved were fingered by the then DPP Keriako Tobiko for their involvement.

At least six banks had been under investigations for their roles in processing the cash which was reportedly aided by banking insiders.

Some of the transactions more than Sh1 million were so huge they required lenders to report to Financial Reporting Centre (FRC) but the banks failed to do so.

Some funds were drawn over the counter with no documentation and others without due diligence that allowed the NYS companies to open accounts a few hours before the NYS money was credited.

Under the first Sh791 NYS scam, Family Bank suffered a beating when it emerged some of its staff were involved were fingered by the then DPP Keriako Tobiko for their involvement.