CBK Currency Demonetisation - A step in the fight against corruption

CBK Currency Demonetisation - A step in the fight against corruption

The writer is the Governor of the Central Bank of Kenya (CBK)

On September 30, 2019, the withdrawal of the old series Ksh.1,000 notes was successfully concluded. This demonetisation commenced on June 1, 2019, following the launch of Kenya’s new generation notes. The new notes symbolize green energy, agriculture, social services, tourism, and governance, which are the drivers of a Newly Reborn and Prosperous Kenya.

In deciding to withdraw the older series Ksh.1,000 notes, the Central Bank of Kenya (CBK) assessed the grave concern that these notes were being used for illicit transactions and financial flows, in Kenya and in the region. More recently, there has also been the emergence of counterfeits. Both these concerns posed a threat to the credibility of Kenyan currency and required swift action.

Read also: CBK says consumers should only worry about unlicensed digital lenders

In designing the demonetisation strategy, CBK examined the experiences of other countries, such as Australia, the European Union, Pakistan, the United Kingdom, and most recently India. All considered the critical consideration was to balance the objective of addressing illicit financial flows and counterfeits while ensuring that the process was not disruptive to the public and the economy. In this regard, a gradual approach over four months was preferred over an abrupt shock and awe approach. Four key elements underpinned the strategy.

First, ample public awareness was doubly important, also given that CBK had concurrently launched the New Generation Currency. It was critical that Kenyans across the length and breadth of the country were made aware of the ongoing demonetization but also the features of the new currency.

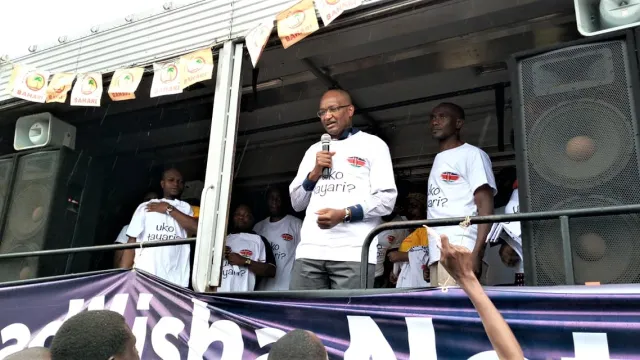

To this end, CBK with support from the banking sector and other stakeholders traversed the country—from Nairobi to Lunga Lunga, Kisumu to Garissa, Wajir to Kakuma—engaging all Kenyans in market places, barazas, streets, and bank branches. A multi-channel campaign was also executed, with over 15,000 advertisements, coverage in social media, television, newspapers, and over 80 mainstream and vernacular radio stations.

Second, it was important to quickly provide and maintain a wide availability of the new currency. CBK worked closely with banks to ensure a smooth rolling out of new currency across the country and its availability. CBK’s immediate support to banks and other players was needed to recalibrate the verification and note-counting machines, ATMs, and parking payment machines so as deal with the new notes. Special emphasis was placed on the far-flung areas, in the northern and southern parts of the country, cognizant of the heavy use of cash in those regions. To identify any emerging concerns and facilitate their resolution, a robust feedback mechanism including some strategic surveys was also deployed.

Third, for the demonetization to be successful it was essential that existing measures on Anti-Money Laundering (AML) and Combatting Financing of Terrorism (CFT) be applied fully.

These measures ensured that illicit funds were filtered out, and not exchanged or enter the financial system. Commercial banks, Forex bureaus, and payment service providers (PSP) have over the last few years strengthened their AML/CFT screening, which proved a strong foundation for the demonetization.

Additionally, reporting and monitoring was scaled up, with positive results—during this period CBK conducted 15 targeted inspections on financial institutions, and over 3,000 Suspicious Transaction Reports (STRs) were reported for further investigation.

Fourth, a collaborative approach with other official entities was adopted to buttress the strategy. Investigative agencies were brought on board to examine the available information for evidence of crimes. Other central banks were also roped in to ensure that escape of counterfeiters and perpetrators of illicit funds through those jurisdictions was thwarted.

This approach is akin to an army overwhelming the enemy by attacking on all flanks at once.

As the sun set on demonetization on September 30, 2019, inflation, the exchange rate and other key macroeconomic indicators remained stable. There were no last-minute panic queues outside banking halls—the awareness campaign had been effective and ordinary Kenyans had exchanged their notes in good time. At midnight when the operation was concluded, old series Ksh.1,000 notes valued at Ksh.7.4 billion had not been exchanged and became worthless.

Demonetisation marks a single step in the fight against illicit finance and corruption more generally. Sustained efforts are needed to deliver victory. The strong AML/CFT filters that were applied will continue to be deployed. The information already gathered will also support further investigations by law enforcement agencies. But most importantly, we have created a launchpad for progress towards using less cash for transactions, as we increasingly embrace the readily available mobile and electronic channels. This will make it harder to launder ill-gotten funds, and for cash-based corruption to survive.

The successful conclusion of demonetization is a testament to careful preparation by CBK and close collaboration with commercial banks and other financial institutions, government agencies, other central banks, and most importantly, the public. We owe Kenya a new beginning, a Newly Reborn, and Prosperous Kenya, building an economy devoid of corruption. This is a call for each and every Kenyan.