Sanlam Kenya secures nod for Sh2.5Bn capital raise

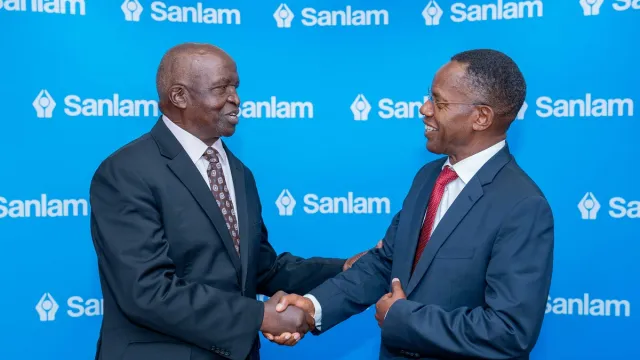

Sanlam Kenya PLC Chairman Dr John Simba (left) shares a light moment with the company's Group CEO Dr Patrick Tumbo (right) at a past event.

Sanlam Kenya has announced that its planned KES2.5 billion Rights Issue will open on Friday, 25 April 2025, and run until Monday, 12 May 2025.

The company aims to raise up to KES2.5 billion through this cash call, a move approved by shareholders during an Extraordinary General Meeting (EGM) late last year.

In an update on Friday, the company said all regulatory approvals have been secured, including clearances from the Capital Markets Authority (CMA), the Nairobi Securities Exchange (NSE), the Insurance Regulatory Authority (IRA), and the South African Reserve Bank (SARB).

This paves the way for the company to proceed with its recapitalization strategy, which is expected to strengthen its balance sheet and drive future profitability.

“While part of the funds will be used to retire the Stanbic debt, a part of the proceeds will also be used to provide management with the operational and financial flexibility to drive the Group’s growth ambitions and sustain its profitability,” explained Dr. John Simba, Chairman of Sanlam Kenya.

He added, “The purpose of the Rights Issue is to bring the Group’s indebtedness to a more sustainable level and will specifically enable the Company to reduce its long-term debt levels, which will save on financing costs currently being charged by the Company’s lenders,” noting that all registered shareholders will be eligible to participate in the offer.

Sanlam Kenya CEO, Dr Patrick Tumbo, said the Rights Issue is fully underwritten by Sanlam Kenya’s parent company, Sanlam Allianz Africa Proprietary Limited, a company incorporated in South Africa, which has undertaken to pick up any untaken rights that remain after allocation to all eligible shareholders.

The company is training its sights on pioneering inclusive financial confidence by investing in diversified non-bank financial services.

“In recent years, we have strategically worked to tighten and enhance our capital and investments management by retiring and restructuring our debt portfolio, divesting from real estate and winding up dormant subsidiaries. These efforts have enabled the Group to maintain a razor-sharp focus on its core insurance businesses, guaranteeing better returns to shareholders,” Dr Tumbo said.

The cash call is being managed by a team of top-tier advisors, including Absa Bank Kenya (Lead Transaction Advisor), Absa Securities Limited (Lead Sponsoring Broker), Anjarwalla & Khanna LLP (Legal Advisor), KPMG Kenya (Reporting Accountant), Stanbic Bank Kenya (Receiving Bank), Image Registrars Limited (Share Registrar), and Oxygène MCL (Marketing Consultants).