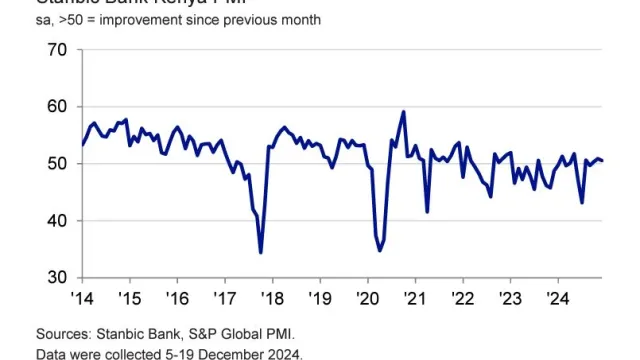

Private sector sees December uptick, but 2025 optimism fades

The headline PMI stood at 50.6 in December, indicating another marginal improvement in the health of Kenya's private sector, although it decreased slightly from 50.9 recorded in November.

New orders, output and employment levels in Kenya's private sector improved for the third consecutive month in December 2024, the latest Stanbic Bank Kenyan Purchasing Managers Index (PMI) shows.

The headline PMI stood at 50.6 during the month under review, indicating another marginal improvement in the health of Kenya's private sector, although it decreased slightly from 50.9 recorded in November.

Readings above 50.0 signal an improvement in business conditions on the previous month, while readings below 50.0 show a deterioration.

"Positively, this is the first quarter of expansion in output since Q4:21, suggesting that the private sector is showing signs of turning around with new orders and employment also in expansionary territory," said Christopher Legilisho, Economist at Standard Bank.

"The improvement is attributed to increased customer sales with an improvement in purchasing power. The PMI also signals healthy growth in purchasing plans in December with a drop in inventories as firms push to clear stocks in the construction and wholesale and retail sectors," he added.

Price inflation

According to the survey, the Kenya PMI revealed a build-up of price inflation in the markets at the end of 2024, as a sharp increase in input costs saw private sector companies increase their selling prices at the quickest rate since December 2023.

Stanbic said this pick-up in cost burdens came as sustained growth in new orders and business activity prompted the fastest expansion in input buying for over two years.

During the final month of 2024, new orders grew moderately among companies surveyed owing to trade activity of the festive season with the upturn easing from November.

Several panellists reported an improvement in purchasing power at customers, alongside new bookings and successful advertising campaigns during the season.

Rising demand helped to sustain the current trend of input buying growth in December, with a rise in purchases registered for the fifth consecutive month. Furthermore, the increase was the sharpest on record since September 2022.

Stronger input demand encouraged suppliers to raise their fees, according to a number of surveyed firms.

"Kenyan businesses reported increased pass-through of purchase prices, and therefore raised their selling prices in December to protect their profit margins," Christopher Legilisho explained.

Additionally, currency weakness and increased tax obligations across the industry were also commonly noted by companies participating in the study. Despite a slightly lower average wage bill, the rate of overall input price inflation accelerated to its quickest for 11 months, Stanbic said.

Selling prices

As a result, selling prices for most goods increased at a sharper pace in the final month of last year. Sector data revealed that agriculture and manufacturing companies faced the strongest rates of both input and output price inflation at the end of 2024.

Kenyan firms reduced their backlogs of work for the second time in three months, indicating spare capacity in the private sector despite sales growth.

At the same time, optimism for higher activity in the next 12 months dropped to its second-lowest in the series history. Only 5 percent of surveyed firms expect output to rise, with these companies basing optimism on planned business expansion and new products and services.

"Private sector confidence in the business outlook for the next 12 months is still quite weak,” notes Christopher Legilisho.

Total employment growth was only fractional. At the same time, businesses offloaded stocks to avoid wastage, leading to the first decline in inventories for five months.