Kenya's inflation cools to lowest level in four years

Kenya's inflation cools to lowest level in four years

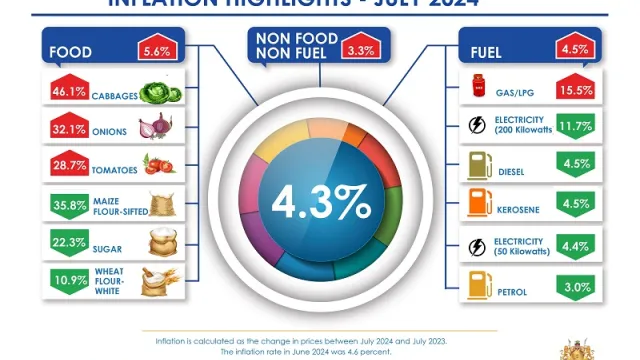

In July, Kenya’s inflation eased to the lowest point in four years, declining to 4.3 percent from 4.6 percent recorded in June, according to the latest data from the Kenya National Bureau of Statistics (KNBS).

This decrease is attributed to several factors, including the robust performance of the Kenyan shilling, which has contributed to lower transport costs and overall price stability.

The month-on-month consumer price index (CPI) in Kenya saw a decrease of 0.2 percent in July, reversing a 0.4 percent rise in June. This decline contrasts with the median forecast of 4.7 percent inflation predicted by economists surveyed by Bloomberg.

The significant drop in inflation could influence the Central Bank of Kenya’s (CBK) decision regarding interest rates, with a potential rate cut anticipated when the Monetary Policy Committee meets on August 6.

Since May 2022, the CBK has increased the key interest rate by 600 basis points to stabilize inflation around its 5 percent target. The recent appreciation of the Kenyan shilling by 21 percent has been a key factor in lowering inflation and has led to a notable reduction in transport costs, which saw a rise of just 4 percent in July compared to a sharper 7.7 percent increase in June. Gasoline prices also saw a slight decrease of 0.53 percent, further easing transportation expenses.

Food prices in Kenya have remained relatively stable, with an annual increase of 5.6 percent in July, matching the previous month's rate. The availability of surplus maize, estimated at 31 million 50-kilogram bags, is expected to help mitigate food inflation until the next major harvest in November, according to Paul Ronoh, Principal Secretary for Agriculture.

However, some food categories experienced significant price hikes: cabbages surged by 46.1 percent, onions by 32.1 percent, and tomatoes by 28.7 percent year-on-year. Conversely, prices for maize and wheat flour saw substantial drops, with sifted maize flour falling by 35.8 percent and brown wheat flour by 9.8 percent compared to June 2023.

In the non-food sector, the cost of cooking gas has increased by 15.5 percent, reflecting ongoing cost pressures. Monthly house rents for one-bedroom apartments have also risen slightly by 1.5 percent. Despite these increases, overall inflation remains under control, bolstered by decreasing fuel prices.

The KNBS reported a 0.5 percent decrease in the Food and Non-Alcoholic Beverages Index between June and July. Specifically, prices for tomatoes, brown wheat flour, onions, and sifted maize flour fell by 5.5 percent, 4.2 percent, 4.1 percent, and 3.3 percent, respectively.

Read also: Digital lenders hit 58 with CBK’s latest approvals

“In particular, prices of tomatoes, wheat flour-brown, onion-leeks and bulbs and maize flour- sifted dropped by 5.5 percent, 4.2 percent, 4.1 percent and 3.3 percent, respectively, between June 2024 and July 2024,” reads part of the KNBS report.

Additionally, the Housing, Water, Electricity, Gas, and Other Fuels Index dropped by 0.4 percent, with a decrease in prices for 200 kWh of electricity, 50 kWh of electricity, and kerosene by 9.4 percent, 4.4 percent, and 0.8 percent, respectively. However, the price of gas/LPG rose by 0.2 percent.

The Transport Index eased by 0.1 percent due to a 0.5 percent drop in petrol prices and a 0.9 percent drop in diesel prices.

The government has set an inflation target range of 2.5 percent to 7.5 percent for the medium term. The central bank’s forthcoming decision on interest rates will be closely watched, as it could impact the broader economic landscape and the stability of the shilling.

The central bank has kept its benchmark lending rate at 13.0 percent since June, citing stable inflation within its target range and a focus on maintaining exchange rate stability.