Finance Bill 2024 sparks industry outcry

Finance Bill 2024 sparks industry outcry

An increasing number of industry lobbies are criticizing various clauses in the proposed Finance Bill 2024, warning that the set tax measures for the FY2024/25 budget cycle will slow economic growth and force many businesses to close.

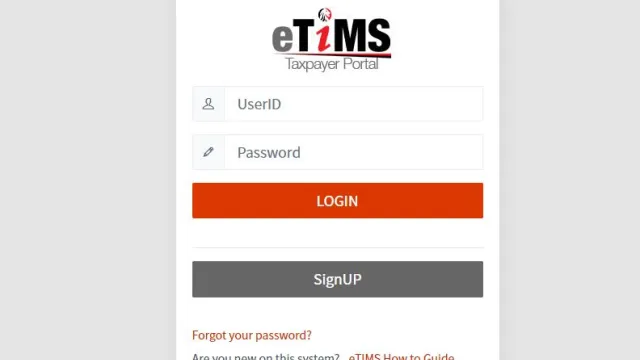

The latest move comes from the Kenya National Chamber of Commerce and Industry (KNCCI), which is now criticizing a proposal in the Finance Bill 2024 to impose a Kes2 million fine on businesses for non-compliance with the electronic tax invoice management system (eTIMS).

In a statement, the KNCCI termed the proposed penalty "punitive" adding that it will severely impact thousands of SMEs in Kenya. Currently, MSMEs account for roughly 40 percent of the country's GDP and provide jobs to approximately 80 percent of the country's workforce.

"Majority of them operate in the informal economy and have neither clearly understood nor adopted eTIMS. This is evidenced by the low performance of the March 31st deadline that saw only 20 percent of the targeted businesses registered on eTIMS."

KNCCI asks for rethink of Finance Bill 2024

According to KNCCI, the lobby's Quarttely Business Barometer Survey for Q2/2024, over half of the respondents were businesses that book less than Kes1 million in annual revenue implying that slapping an entity Kes2 million penalty a month would lead to massive closure of businesses.

KNCCI's call on President Ruto's administration to rethink proposed clauses on the Finance Bill 2024 comes following similar cries from other organisations across the economy.

Last week, the Kenya Bankers Association (KBA), asked the National Assembly to reconsider proposed introduction of 16 percent VAT on Financial Transactions as contained in the Finance Bill 2024.

"The increased cost of banking to customers will hamper financial inclusion efforts, particularly affecting low-income individuals and small businesses. Coupled with Excise Duty, the total taxation on financial services would reach 40%, from the current 15% (excise duty only), significantly impacting affordability and accessibility," KBA statement signed by the acting CEO Raimond Molenje noted in part.

The bankers explained that the proposed VAT will widen the margin charged on foreign exchange transactions, thereby posing risks to economic growth by taxing export proceeds and hindering the competitiveness of Kenyan products.

Read also: Shilling’s rally echoes economic confidence — Bankers

KBA faults VAT on financial transactions

They warned that this move is set to "adversely" affect foreign investments in Kenya, and decelerate the pace of recovery of the tourism industry. "It could further threaten the stability of our foreign currency reserves and undermine efforts to strengthen the Kenya shilling," Mr Molenje added.

Another entity that equally faulted the Finance Bill 2024 proposals is the Association of Battery Manufacturers who termed the planned "Eco tax" on batteries and dry cells set to take effect at Kes750 per kilo.

“A small lead acid battery for a motor vehicle is 12kg, with a retail price of Kes8,500. The Eco tax for this small battery will translate to an additional Kes9,000 plus VAT. Therefore, a small car battery will retail at Kes17,500,” ABM statement signed by CEO Guy Jack read in part.

What's more, the Finance Bill 2024 is set to pile more pressure on motorists through motor vehicle tax, a move that will see insurance premiums go through the roof. According to Tom Gichuhi, the Executive Director of the Association of Kenya Insurers (AKI), motor vehicle tax "will notably increase the cost of motor insurance. Currently, the average comprehensive insurance premium rate stands at 5 percent, and with the additional 2.5 percent, the total premium rate surges to 7.5 percent.”