CEOs press for swift settlement of pending bills

CEOs press for swift settlement of pending bills

Kenyan business leaders are urging the government to expedite the payment of pending bills to improve liquidity for businesses, enabling smoother operations.

Despite numerous circulars and directives from the National Treasury, pending bills and arrears have continued to mount, putting many State suppliers, the bulk of which are private companies, in huge financial distress. By September 2023, the national and county governments owed suppliers and contractors a total of Kes631.56 billion.

The call is captured in the Central Bank's latest survey on CEOs and comes as companies in Kenya grapple with rising costs and economic uncertainty, which could hamper growth over the next year.

Additionally, CEOs are asking the government to explore alternative strategies to stimulate growth and enhance revenue collections, especially after the withdrawal of the Finance Bill 2024.

The elevated cost of doing business, coupled with the ongoing political unrest and recent protests, remains a significant concern for companies. The Central Bank of Kenya’s survey highlights these factors as key domestic issues that could constrain growth.

While the situation poses challenges, easing inflation, a stable shilling, and favourable weather conditions are providing some relief, particularly in the agriculture sector.

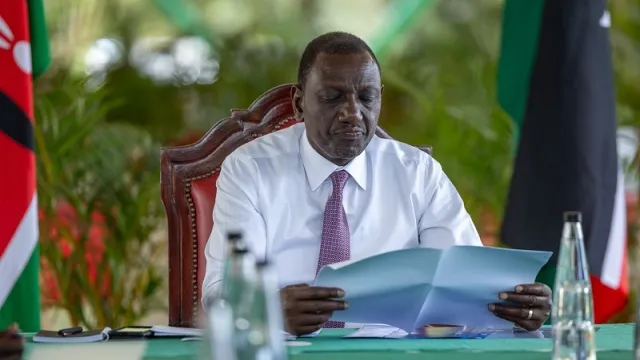

Read also: Ruto declines to sign Finance Bill 2024

In the agriculture sector, CEOs reported higher demand orders in the second quarter, sales growth, and increased production volumes, driven by favourable weather conditions which have been prevailing across the country.

However, the manufacturing industry is facing subdued business activity, with lower demand, production, and sales growth. High operational costs, weak consumer demand, and competition from imports are major hurdles for manufacturers, leading many to halt expansion plans due to the uncertainties caused by political unrest, the survey revealed.

Despite these challenges, company CEOs are looking internally to drive growth during the year. CBK said CEOs are banking on various customer-centric strategies, effective talent management, and technological innovation to drive business performance over the next 12 months.

The captains of the industry are also focusing on improving efficiency, diversifying revenue streams, and developing new products to strengthen the outlook of businesses.

Looking ahead, CEOs believe that a stable economic environment, political stability, and a favourable business climate will be crucial in strengthening their growth prospects.

The stability of the Kenya shilling and clear taxation policies are also highlighted as essential external factors that could boost business confidence and performance.