Absa commits 10% of loan portfolio to eco-friendly ventures

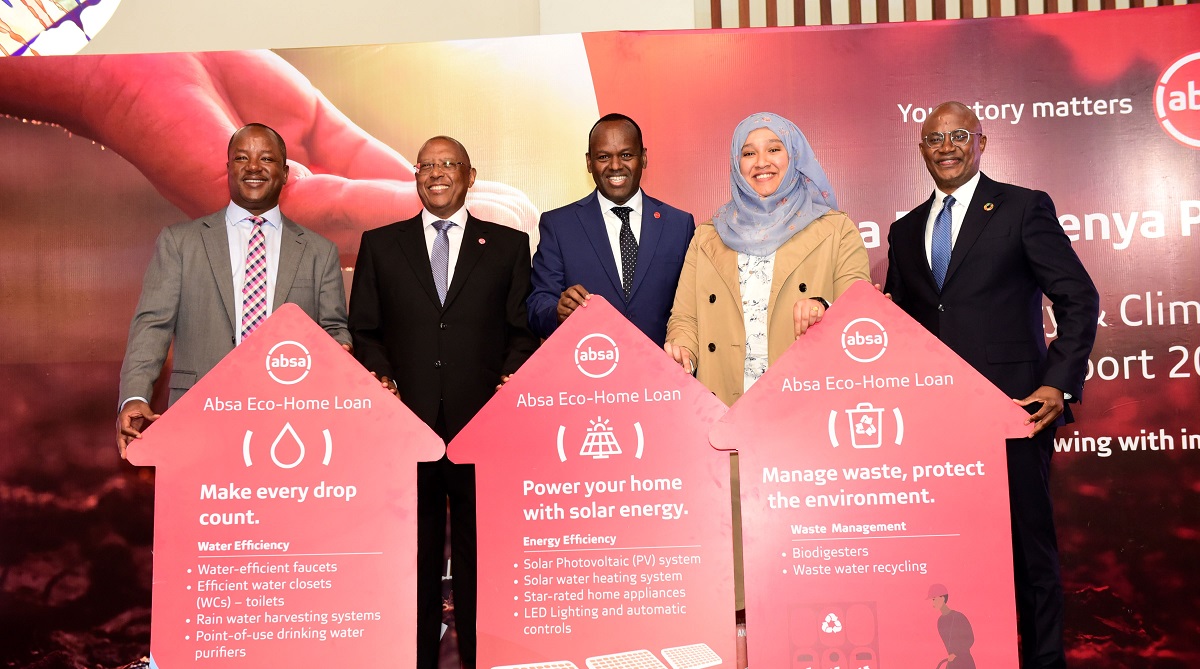

Absa Kenya CEO Abdi Mohamed launches the bank's 2024 Sustainability and Climate Report.

Absa Bank Kenya is rolling out an ambitious strategy to ensure that 10 percent of the lender's credit portfolio goes to finance green projects by the end of this year.

This commitment under the lender's climate finance strategy that aims at powering the growth of the bank's green portfolio while accelerating the country's pace of energy transition.

"In 2024, the board [Absa Bank Kenya] came up with a strategy on climate financing. That strategy captures the essence of the ambition that we as a business have in that area. And the guidance to management is quite clear: We would want at the end of 2025 to have 10 percent of our lending portfolio going into climate related financing... to truly green projects," Absa Bank Kenya Board Chairman Charles Muchene explained during the release of the bank's 2024 Sustainability and Climate Report on Friday.

The report themed, "Rooted in purpose, growing with impact," shows that Absa Bank Kenya disbursed KES4 billion under to borrowers under the climate finance portfolio.

Financial inclusion

In fostering financial inclusion during the year under review, Absa Bank sustainability report shows that the lender disbursed KES47 billion in sustainable finance targeting MSMEs, women- and youth-led enterprises, and underserved segments.

The bank said out of this amount, Absa’s digital lending unit, Timiza, accounted for KES25.1 billion worth of credit, highlighting the increasing role of digital infrastructure in closing access gaps.

As part of achieving 10 percent allocation target of credit to climate smart initiatives, Absa has today unveiled Kenya’s first Eco-Home Loan, a product that seeks to offer borrowers up to 110 percent financing to help them build or upgrade homes with energy-efficient and climate-resilient features.

“Sustainability is now a business imperative. Over the past three years, we have embedded it as a core lens through which we evaluate risk, opportunity, and long-term impact. This is now translating into tangible results from inclusive lending and supply chain empowerment to financing solutions that actively support Kenya’s transition to a low-carbon, climate-resilient economy. The Eco-Home Loan is one example of how we are taking this forward," explained Absa Kenya CEO Abdi Mohamed.

Meanwhile, while releasing the 2023 sustainability report, Absa Bank announced plans to trail blaze the industry with the adoption of the latest accounting standards in the segment as part of a global push for firms to meet interests of investors and regulators.

IFRS S1 and S2 reporting standards

Commenting on the adoption of new standards in the 2024 report, Absa Bank Kenya Chairman, Charles Muchene, stated “The 2024 report reflects our continued evolution towards sustainability maturity and greater alignment with global standards. It marks the early stages of adopting the International Sustainability Standards Board (ISSB) guidelines, IFRS S1 and S2, which are poised to become the global benchmark for sustainability disclosures. We see this as a necessary shift to build investor confidence and comparability.”

Meanwhile, on climate action, the bank reported a 38 percent decrease in Scope 2 emissions, attributable to electricity purchases compared to the 2019 baseline.

Absa said the reduction was driven by retrofitting and smart metering projects across its premises.

For 2024, 2,745 kilograms of waste were recycled, with a 94 percent recovery rate helping avoid close to seven tonnes of CO₂-equivalent emissions, the report states in part.

Tree planting

Additionally, Absa also planted 72,000 tree seedlings during the year under review, bringing to over 1.5 million trees the number of trees grown by the organization as part of its reforestation efforts.

Looking ahead, the Nairobi Securities Exchange listed company has committed to develop and implement its "next horizon sustainability strategy" to guide its key priorities and social impact areas for the period 2026--2030.

What's more, the bank will be operationalizing its newly set up Absa Kenya Foundation by implementing its anchor programme—entrepreneurship, education and skills, natural resource management, and health and humanitarian relief—in line with the five-year strategy in order to scale impact.

Absa Bank launched its Foundation in October last year, investing a total of KES500 million in a seed capital while announcing that it will be dedicating 1.5 percent of the lender's annual earnings to the organization.

Absa Kenya Foundation

Since its establishment, Absa Kenya Foundation has consolidated a number of community programmes, investing KES107 million in citizenship and financial literacy programs. Already, over 11,000 youth have gained key traders through the Bank’s ReadytoWork platform, while 635 staff members participated in community outreach initiatives valued at KES41 million.

Internally, Absa maintained strong performance on inclusion, with a 51:49 females to male ratio and continued Top Employer recognition.

Additionally, governance systems were further recognised strengthened through Board-level oversight of climate risk and sustainability disclosures, approval of a Greenwashing Policy, and alignment with CBK’s Climate Risk Guidelines and Kenya’s Green Finance Taxonomy.

“As a purpose-led business, our focus is on creating shared value across the ecosystem. This report signals our ambition to accelerate action towards 2030 and beyond," CEO, Abdi Mohammed noted.