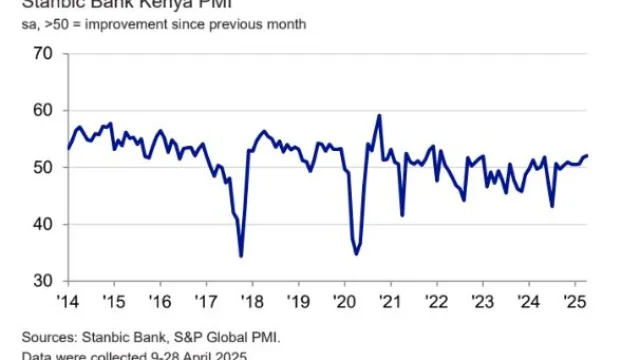

Private sector roars back in April as PMI hits 15-month high

Key gains were observed across the services, agriculture and construction industries, contrasting with lower sales in manufacturing and wholesale and retail sectors during April 2025.

Kenya's private sector activity surged in April, with the Stanbic Bank Purchasing Managers’ Index (PMI) hitting 52.0—the highest since Jan 2023.

According to the monthly survey, strong customer demand drove the fastest rise in new employment opportunities in over three years, boosting output and purchasing.

"Employment conditions improved too in response to higher sales that led to increased workloads for firms, especially those in services and construction," stated Christopher Legilisho, Economist at Standard Bank.

He added, "to address rising demand from consumers, firms ramped up purchasing activity and increased inventories of raw materials and key inputs. This was especially so in the services and agricultural sectors."

Survey showed that new orders across industries posted the fastest uptick since February 2022, as Kenyan companies reported a sharp upturn in demand and additional sales from marketing.

Additionally, gains were observed across the services, agriculture and construction industries, contrasting with lower sales in manufacturing and wholesale and retail during the month under review.

As was the case in the end of first quarter, strong new business expansion encouraged a solid growth in overall activity during April. Notably, just over a third of surveyed businesses or 34 percent registered an increase in production, with some panellists also noting a positive impact from rising customer movement and subdued cost pressures.

In line with the new orders trend, purchases of inputs increased to the greatest degree since February 2022. Firms typically raised their input buying to meet rising workloads and boost their inventories.

"Output prices also rose as firms passed on buying-price increases to consumers," noted Legilisho.

Subsequently, stocks grew at a modest pace that was the quickest since last October. Lead times continued to shorten, despite some reports of weather-related delays.