Kenya’s private sector sees modest growth in February

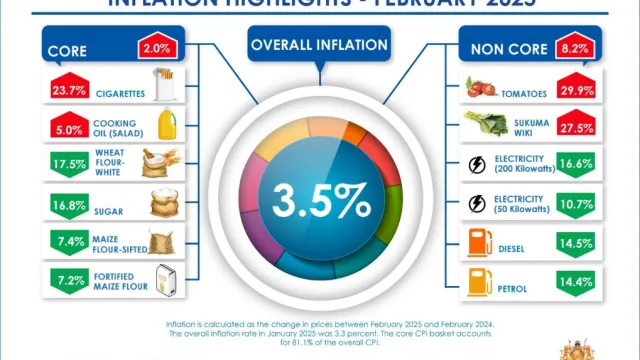

Lower inflationary pressures which was reported at 3.5 percent by the Kenya National Bureau of Statistics in February also supported the upturn, as both input and output prices rose at the slowest rates for four months.

Players in Kenya's private sector businesses reported another improvement in operating conditions during the second month of this year, continuing the growth streak that began in late-2024.

The February Stanbic Bank Kenya PMI survey evident signals that a greater stabilization of the wider economy drove higher demand and output across industries.

Additionally, lower inflationary pressures which was reported at 3.5 percent by the Kenya National Bureau of Statistics during the month, also supported the upturn, as both input and output prices rose at the slowest rates for four months.

"Positively, firms are focused on increasing inventories due to strong demand in output in agriculture, manufacturing and construction as well as improving efficiencies among their vendors. Pricing pressures were muted due to soft increases in input and purchase prices, while staff costs remained even," stated Christopher Legilisho, Economist at Standard Bank.

At 50.6 points in February, up from 50.5 points recorded in January, the headline Stanbic Bank Kenya PMI was consistent with a strengthening of business conditions for the fifth month running. However, the reading was below its long-run average of 51.2 and signalled only a marginal overall improvement.

Across industries, the survey shows the volume of new orders went up for the fifth consecutive month, with players in private sector reporting improving cash flow, softer price pressures and new products and services. However, many firms reported challenges in boosting sales, resulting in an overall rate of new business growth that was only slight, stated Stanbic Bank survey.

"However, the improvements in demand conditions were not widespread across all sectors surveyed. The services sectors, that saw weaker output and new orders growth, experienced increased competition as well as consumers under increased financial pressure. Further, there was less input buying in services as well as wholesale and retail in February," explained Legilisho.

Although employment growth recovered to a four-month high, survey shows that it was weaker than its long-run trend. Similarly, the uplift in stocks was below-average, as purchasing activity fell for the first time since July 2024.

Looking ahead, business expectations regarding future output weakened during the month under review. Only 5 percent of surveyed firms expect output to rise over the next 12 months, with positivity only recorded in three of the five monitored categories: construction, wholesale & retail and services.