Kenya courts Japan with Sh22Bn Yen loan amid debt pressure

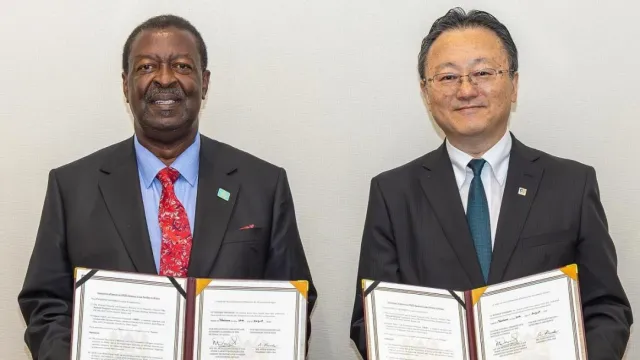

Prime Cabinet Secretary Musalia Mudavadi (left) with Chairman and CEO of Nippon Export and Investment Insurance (NEXI), Mr. Atsuo Kuroda.

Kenya has secured a KES21.7 billion (JPY25 billion) yen-denominated loan for budget support as well as financing the country's electricity loss reduction programme.

The credit line, which will be insured by Nippon Export and Investment Insurance (NEXI), will be provided by a number of Japanese commercial lenders.

"These investments will help cut power losses, lower energy costs, and advance Kenya’s vision of becoming Africa’s industrial and green mobility hub," stated Prime Cabinet Secretary Musalia Mudavadi upon signing Statement of Intent on the Samurai Financing Facility with Mr. Atsuo Kuroda, Chairman and CEO, of NEXI.

A statement from Japan's Foreign Office noted: "The credit line is expected to support Kenya's industrial development and local job creation by supporting the government's efforts to grow its automotive industry. It is also expected to contribute to the sales of Japanese vehicles, which hold a strong market share in the Kenyan market,"

It added: "In addition, the facility will support the Kenyan government's initiatives to reduce electricity loss rates across its transmission and distribution networks."

The Sammurai loan deal, which was entered into last week on the sidelines of the Japan-Africa leaders conference, (TICAD) held in Yokohama, builds on an agreement signed between Kenya and NEXI in February last year.

It was tailored to increase financial cooperation with the country, an update from the Japan's Ministry of Foreign Affairs. NEXI's insurance backing is tailored to lower the borrowing costs for sovereign credit commitments by mitigating risks for investors.

Diversified pool of financing

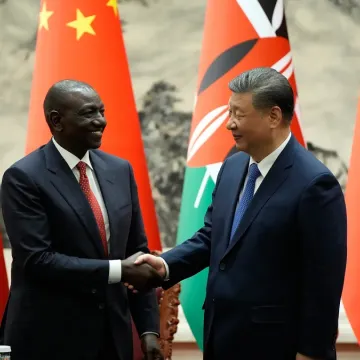

President William Ruto's government has been exploring a diversified pool of financing avenues to pay for massive infrastructure projects while also offering budget support to drive economic growth in the face of increasing global uncertainties.

At the moment, the National Treasury is in talks with authorities in China, seeking to switch the country's $5 billion (about KES630 billion) railway loan into yuan-denominated agreement seeking to save roughly KES120 billion in interest payments per year.

"NEXI remains committed to deepening collaboration with governments and institutions worldwide, and to actively supporting the creation of business opportunities for Japanese companies in emerging markets, including Africa," Japanese government explained.

Kenya's strategy to diversify external financing platforms has been mirrored by other economies in Africa including Ivory Coast, which raised JPY50 billion in an ESG-certified samurai bond in July.

Just like China, the UK, the European Union, U.S., and other global superpowers, Japan has been reaching out to economies in Africa, seeking to deepen investment and trade opportunities.

Japanese multinationals have an established presence across different sectors including, energy, road infrastructure and scientific research.

"GDP is expected to grow 5.6 percent this year, despite global domestic headwinds arising from escalating tariffs and trade disruptions affecting many economies," President Ruto said at the the TICAD forum.