Treasury backs Hustler Fund with Sh300M despite defaults

Branded as President William Ruto’s flagship youth empowerment plan, Hustler Fund has become both a symbol of hope for small-scale traders but also a lightning rod for his increasing number of critics.

Despite statistics showing that Hustlers are increasingly defaulting on loans, Hustler Fund is set for another cash injection for the financial year starting July 1st—this time to the tune of KES300 million.

Branded as President William Ruto’s flagship youth empowerment plan, the fund has become both a symbol of hope for small-scale traders and a lightning rod for his increasing number of critics.

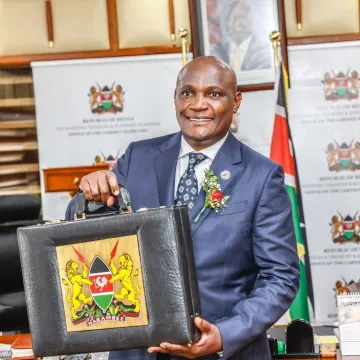

As Treasury Cabinet Secretary John Mbadi unveiled the KES4.3 trillion budget for FY2025/26, he hailed the Hustler Fund—officially the Financial Inclusion Fund—as a critical lifeline for households and MSMEs struggling to access affordable credit in a tightening economy. But as optimism and arrears collide, the fund's true impact hangs delicately in the balance.

“The Government recognizes the challenge of accessing affordable credit by most MSMEs and Kenyans at the bottom of the pyramid. To address this challenge, I have proposed an additional allocation of KES300 million to the Financial Inclusion Fund,” said CS Mbadi.

However, the fund has come under scrutiny with latest revelations by MSMEs Principal Secretary Susan Mang’eni, who noted that up to 10 million Kenyans borrowed money from the fund between November and December 2022 and never paid it back.

“We will be considering a write-off of about KES6 billion for individuals who borrowed and vanished. But we are not at the write-off stage at this moment because we are pursuing defaulters,” Mang’eni said while meeting with the National Assembly’s Committee on Trade, Industry and Cooperatives.

The PS also noted that there about nine million “good borrowers” as they have consistently repaid their loans since the establishment of the fund in 2022. A total of 25.8 million Kenyans have enrolled under Hustler Fund.

Statistics shows that the Fund had disbursed over KES39.7 billion to 21.8 million Kenyans, and mobilized KES2 billion in savings, while total repayments hit KES28.75 billion by the end of 2023.

As part of reforms to the Fund in a shift aimed at broadening access to credit, the government has moved away from blacklisting defaulters. It instead focused on restoring their creditworthiness, a move that saw seven million Kenyans delisted from the Credit Reference Bureau (CRB).

Hustler Fund was designed to empower Kenya’s economically marginalized citizens, the so-called “hustlers.” However, it has emerged that its most frequent borrowers come from the wealthiest segments of the population, and not the hustlers.

According to the 2025 Economic Survey, Hustler Fund is heavily used by the wealthy, with 35.8 percent of individuals in the highest wealth quintile and 33.5 percent in the second-highest tapping into the mini-credit programme.

Beyond the top earners, 28.8 percent of middle-income individuals also accessed the Hustler Fund, followed by 26.2 percent from the second-lowest quintile. In stark contrast, only 18.7 percent of those in the lowest wealth bracket, the fund’s intended beneficiaries, actually made use of it even as default rates are on an all-time increase.

Generally, the government plans to inject over KES2.4 billion into the MSME sector over the next year starting July 1, 2025, in its attempt to boost growth and transformation within the sector.

Additionally, the government has also allocated KES300 million to the Youth Enterprise Development Fund, KES600 million to the Centre for Entrepreneurship Project, and KES1.3 billion to the Rural Kenya Financial Inclusion Facility while the MSME agricultural credit got an additional KES200 million in CS Mbadi’s budget.

“I have also proposed an additional KES 308 million for the Youth Enterprise Development Fund; KES 550 million for the Centre for Entrepreneurship Project; and KES 1.3 billion for Rural Kenya Financial Inclusion Facility,” he announced.