Shilling's tough year expected as East Africa outshines the continent

Shilling's tough year expected as East Africa outshines the continent

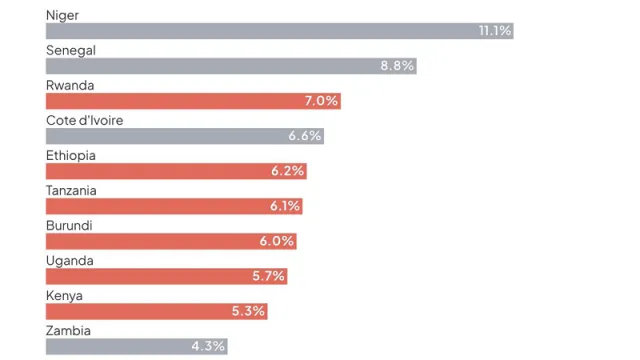

Economies across East Africa are poised to achieve higher growth rates than their counterparts in other regions across the continent, even as Kenya, the giant economy in the area, grapples with a weakening shilling.

Stears' 2024 Africa Outlook Report notes that Kenya expects persistent currency depreciation and inflationary pressures. The Kenyan Shilling lost nearly 20 percent in value to the US dollar and other major currencies in 2023 a decline that prompted the central bank to effect a big interest rate increase in December to stem further loss.

Stears notes that Kenya's inflation averaged 7.8 percent in 2023 and is forecasted to range between 6 percent and 7.4 percent this year. This projection by the economic analysis and data-driven insights company based in Nigeria aligns with the Central Bank of Kenya's inflation target range of 5±2.5 percent, reflecting a global trend aiming for enhanced price stability.

Furthermore, the report reveals a closer alignment of the Kenyan Shilling (KES) to its fair value, shedding light on the delicate balance between inflation dynamics and investor attractiveness.

Nevertheless, Kenya's GDP per capita stands 30 percent above the Sub-Saharan Africa average, signaling increased consumer spending and positioning the country as a significant market.

The report, however, highlights the potential for further GDP per capita growth, primarily through improved job creation in high-value sectors like manufacturing and services.

Overall, Nigeria-based Stears forecasts that the economies of Kenya, Rwanda, Tanzania, and Uganda will be key drivers of regional growth, collectively contributing significantly to economic resurgence.

Read also: EIB Global pumps Sh4.8 billion in Seedstars Africa Ventures I fund

East Africa’s economic resilience

"East Africa's growth is propelled by dynamic sectors such as natural resources, transportation, tourism, and agriculture. Significantly, there is potential for further acceleration due to increased investment from Gulf countries," says Fadekemi Abiru, Head of Insights at Stears. "These developments are shaping East Africa into a model region for economic resilience and diversification," adds Fadekemi Abiru.

This year, Stears' 2024 African Outlook Report states that Africa's overall growth is forecasted at 4.0 percent, a notable increase from 3.3 percent in 2023, positioning it as the second-highest globally, trailing only Asia (4.8 percent).

The report notes that regional economic giants South Africa, Egypt, and Nigeria are poised for growth rates below the regional average, highlighting the diverse economic landscapes that exist within the continent.

At the same time, the 2024 African Outlook Report delves into Nigeria's macroeconomic landscape, revealing a formidable challenge in the form of a high headline inflation rate, currently at 28.2 percent. Stears projects an average annual inflation rate ranging from 27.59 percent to 31.85 percent for 2024, necessitating proactive measures for economic stability.

Petrol subsidies in Nigeria

Dumebi Oluwole explains, "The elimination of petrol subsidies has significantly increased the cost of living for consumers, leading to an overall uptick in inflation. Coupled with the devaluation of the naira, this has precipitated higher exchange rates, complicating the economic landscape for both consumers and businesses."

Stears emphasizes the need for strategic interventions to enhance liquidity and stabilize the exchange rate, highlighting the importance of collaborative initiatives between the government, regulatory bodies, and the private sector for sustained economic growth.

Yvette Dimiri, Director at Stears, articulates the vision behind the report, stating, "Our 2024 African Outlook Report reflects Stears' commitment to providing data-driven insights that transcend conventional narratives. As Africa navigates its course in the global economic landscape, understanding distinctive growth trajectories and leveraging regional strengths will be key."