Ruto’s SGR loan dilemma: Currency swap with China or debt default?

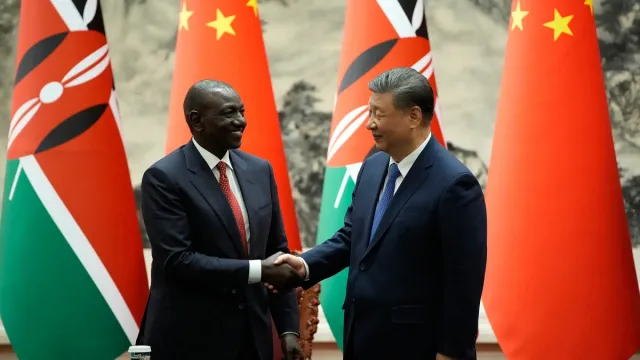

Kenyan President William Ruto and Chinese President Xi Jinping announced upgraded relations during Dr. Ruto's state visit to Beijing in April 2025. (Photo/Louisiana First News)

Faced with ballooning risk of debt default, Kenya has opened negotiations with China to secure a repayment reprieve by turning the country's US dollar-denominated loan secured to construct the Nairobi-Naivasha Standard Gauge Railway (SGR) into Chinese yuan.

According to Reuters, Treasury Cabinet Secretary John Mbadi said the conversion of the railway loan into Chinese yuan would see Nairobi roughly KES129 billion due to lower interest rate repayments.

“The moment we move from the US dollar to the Renminbi (a currency referred to interchangeably with the Yuan), automatically, the interest rate reduces by almost half,” Mbadi stated.

On Wednesday, Bloomberg reported that the move would see Kenya enjoy lower interest rates in comparison to US dollar-denominated loan.

At the moment, China remains the largest bilateral lender to Kenya, holding approximately KES652 billion in debt.

The biggest increase in Chinese lending to Kenya occurred following an agreement to sign a $5 billion (about KES646.2 billion) loan to construct the SGR under former President Uhuru Kenyatta.

Since then, with little legroom to raise revenues amid a tough economic environment, authorities in Kenya have been on the receiving end with the International Monetary Fund and the World Bank warning that the country is hurtling towards debt distress in the face of thinning revenues amid defaults.

Last year, the government of President William Ruto was ruffled by a youth-led revolt against proposed increase in taxes via Finance Bill 2024, a proposal that the administration had bet big that it would collect enough revenue to improve its weak financial position. President Ruto was forced to shelved the proposed tax law.

SGR loan repayment has been a veritable thorn in the flesh for Kenya's Treasury for a number of years now.

During the fiscal year ended June 30, 2022, a number of banks in China, led by the Export-Import Bank of China, slapped the National Treasury KES1.312 billion in fines for defaulting on SGR loan obligation. In November last year, Business Daily reported that Kenya defaulted on a KES167.5 billion.

The loan for the construction of Kenya's Mombasa to Naivasha was secured from a number of key banks across China.

According to statistics from the Ministry of Transport, authorities spend roughly KES1 billion every month to run the SGR. This amount is separate from the initial construction loan, which is being repaid, too.

In February this year, the country announced the postponement of takeover of SGR operations by six months to December 2025.

Earlier, the government had projected to assume the steering of SGR, currently under the stewardship of China Road and Bridge Corporation subsidiary, the Africa Star Railway Operation Company (Afristar).

For years, debate has been rife in the country that Afristar could raid SGR and or other critical assets in Kenya if the country fails to honor its debt obligations, a move that could further damage Nairobi's credibility in the international financial markets.

The government, however, continues to deny that such a case would ever occur, noting that the Treasury is in position to service sovereign debts as and when they fall due.