Lobby warns VAT charge could shrink Kenya's solar sector by 20%

Lobby argues that reinstating VAT on solar equipment could force sector companies to scale down their operations, resulting in the loss of 10,000 jobs, often those serving rural communities.

A proposed 16 percent VAT on solar equipment in the 2025 Finance Bill threatens to derail a decade of progress, slamming the door on affordable electricity for millions and jeopardizing thousands of livelihoods overnight.

If enacted, this tax would instantly push up the price of a basic off-grid solar system—a lifeline for rural families—by roughly KES2,000, placing it beyond reach for those who need it most, GOGLA, the sector lobby has warned.

GOGLA warns that the country risks 20 percent market collapse within a year, risking 10,000 jobs and leaving entire communities in the dark. Besides, the tax move would deal a body blow to Kenya’s climate goals, and economic resilience.

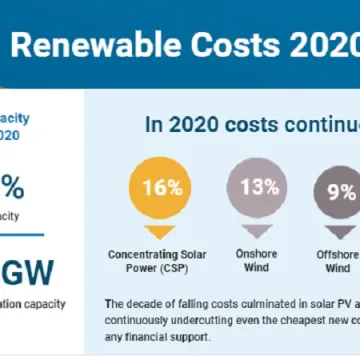

“This is not merely a theoretical concern,” said Patrick Tonui, Head of Policy and Regional Strategy at GOGLA. “When VAT exemptions were previously withdrawn in 2020 and 2021, the off-grid solar market contracted by 20 percent. Reintroducing VAT now risks repeating that experience — dampening demand, reducing tax revenues, and making solar less accessible for the households and enterprises that need it most.

He adds, "Kenya has made remarkable strides in expanding energy access. Preserving those gains requires policy choices that continue to prioritise affordability, job creation, and inclusive growth.”

According to the lobby, Kenya’s solar sector supported an estimated 30,000 jobs last year and contributed over KES4 billion in taxes. This means that reinstating VAT could force solar companies to scale down their operations, resulting in the loss of 10,000 jobs, often those serving rural communities with limited employment opportunities.

The fallout would ripple across the economy: last-mile agents would lose income, while mobile phone use would decline as solar charging becomes unavailable, and farmers relying on solar for irrigation and refrigeration could face lower yields and higher costs.

Currently, off-grid solar kits remain a lifeline for the one in three Kenyan households that still live beyond the reach of the national grid. Today, over three million households rely on off-grid solar products to light their homes, power businesses, and support farming.

With VAT, even the most basic solar kits could become unaffordable for many.

GOGLA and the Kenya Renewable Energy Association (KEREA) are urging lawmakers to maintain VAT exemptions on solar equipment in the 2025 Finance Bill.

Further, they call on the government to continue prioritising clean energy affordability, job creation, and rural inclusion — and to protect public programmes already working to close the energy access gap.

At the moment, Kenya is arguably Africa’s biggest solar success story. Over the past decade, electricity access has surged from 37 percent in 2013 to 79 percent in 2023, with off-grid solar accounting for more than 20 percent of that growth.

“Kenya has made strong progress in expanding energy access, especially in underserved regions through initiatives like the Kenya Off-Grid Solar Access Project (KOSAP)” said Cynthia Angweya-Muhati, CEO of the Kenya Renewable Energy Association (KEREA).

“Electrification in these regions remains well below the national average, with some counties as low as 15 percent. Reintroducing VAT could make solar unaffordable for those who need it most and risk slowing progress toward universal access.”

KOSAP, backed by the World Bank, was designed to reduce costs and bring solar to counties historically left behind — including West Pokot, Turkana, Marsabit, Isiolo, Wajir, Garissa, and others. The VAT proposal risks undermining these efforts.