Downtimes, delays, and cash losses: the woes of Kenya’s financial sector

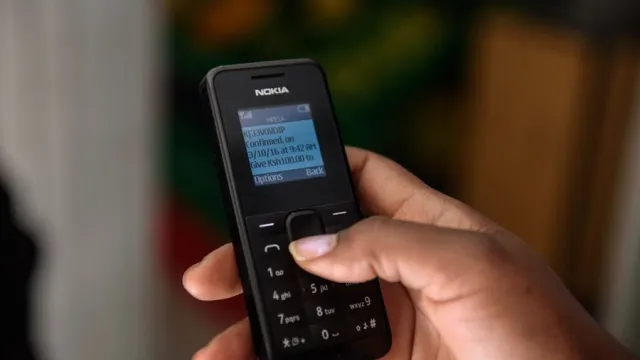

For mobile money subscribers in Kenya, an estimated 21.1 percent reported system failures as a key issue in undertaking their transactions, followed by loss of their money at 9.8 percent, the 2024 FinAccess Household study notes.

Pensioners, insurance policyholders, and mobile money users in Kenya grappled with a mix of challenges including loss of money and system downtimes from service providers in the last year, negatively affecting their customer experience, a new survey shows.

For mobile money subscribers, an estimated 21.1 percent reported system failures as a key issue in undertaking their transactions, followed by loss of their money at 9.8 percent, the 2024 FinAccess Household study notes.

An estimated 38.7 million people use mobile money in Kenya implying that 21.1 percent or about 8.2 million subscribers experienced system outages in the last 12 months.

Additionally, the survey revealed that 9.8 percent of SACCO customers cited system failures as one of the primary hindrances to enjoying smooth services from their savings and credit service institutions.

However, "SACCOs experienced substantial reductions in reported transparency issues, dropping to 4.9 percent from 46.3 percent. SACCOs have enhanced member awareness through public campaigns, increased use of SMS communication to educate members, and improved product disclosures for savings and loans," the study noted.

Sacco sector regulator, SASRA, introduced market conduct guidelines that enhanced price transparency and promoted fair credit charges, a move that has gone a long way in improving customer experience.

Furthermore, across Kenya's expanding mobile banking segment, 5.6 percent of respondents singled out system failure and communication woes from lenders as persistent bottlenecks that continue to hurt customer-business relationships. "Bank users noted system failure as their top issue at 11.0 percent," the study adds.

Additionally, user experience with products and services is a critical factor in promoting financial inclusion. Poor customer service that falls short of expectations, discourages the consumption of services and is one of the key pointers to a lack of understanding of user needs by service providers.

Poor service

In Kenya's financial services industry, the highest record of poor service was reported among account holders of microfinance institutions (MFIs) and policyholders in insurance companies at 7.1 percent and 6.8 percent, respectively.

In contrast, mobile bank accounts recorded the fewest instances of poor service. Similarly, banks reported a decline in transparency issues from 32.1 percent in 2021 to 4.6 percent in 2024, while mobile banks saw a drop from 19.1 percent to 1.9 percent over the same period.

Despite these advancements, new concerns emerged for Chama/groups, with 28.9 percent of users reporting unexpected charges in 2024.

Insurance consumers encountered various challenges, the top among them being delayed payments, impacting 10.1 percent of the respondents. Another concern for customers in Kenya's insurance industry was the lack of transparency as noted by 6.1 percent of respondents.

According to the study, lack of transparency by insurers "reveals shortcomings in communication of terms and conditions of insurance policies by insurance providers."

Although insurance collapses were less common at 0.4 percent, they still posed threats to consumer trust and financial security within the period under focus.

Meanwhile, the most prevalent challenge that hit pensioners thereby affecting their financial security was delayed payments as reported by 3.5 percent of the respondents.

"This problem might be more pronounced among those in schemes with funding issues, particularly the unfunded defined benefits scheme for civil servants," the study explained.