Digital tax down to 1.5% in 2025 Finance Bill — Mbadi

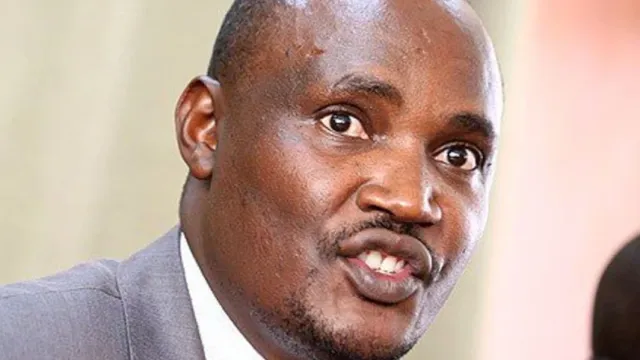

National Treasury Cabinet Secretary Jon Mbadi.

Players in Kenya’s digital economy are poised to experience relief in duty once the National Treasury cuts the levy on digital assets by half to 1.5 per cent in the 2025/26 fiscal year.

The duty, which was introduced in 2023, targets individuals and companies dealing in cryptocurrencies and non-fungible tokens (NFTs), data, images, videos and written content.

"For uniformity, we have reduced that to 1.5 percent, so both the digital and the turnover tax will be at the same figures," National Treasury Cabinet Secretary Jon Mbadi stated during a town hall session at Daystar University on Wednesday.

He added, “When you have lower rates on consumption taxes, you raise more revenue, which in turn enhances revenue collection.”

The reduction of the levy is part of measures to align it with the 1.5 percent turnover tax levied on business people whose gross turnover is between KES1 million and KES25 million a year.

First introduced in the 2023 Finance Bill, the Digital Asset Tax also targets small businesses just like the Turnover Tax.

"Digital tax will be reduced from 3 per cent to 1.5 percent in the new budget. The argument from players in the digital space has been that they are largely small business people, hence the need for uniformity. Also, to enhance compliance, which in turn enhances revenue collection," he added.

In Kenya, digital asset refers to anything of value that is not tangible such as cryptocurrencies, token code, number held in digital form and generated through cryptographic means or otherwise, by whatever name called.

These assets usually provide a digital representation of value exchanged with or without consideration that can be transferred, stored or exchanged electronically.

Digital tax applies to revenues earned on digital or social media platforms, too. This includes content creators who earn income through digital spaces, platforms, and online marketplaces operating in the country, such as Jumia, streaming services such as Netflix, digital advertising platforms like Google Ads and Facebook, subscription-based services including Spotify, and even content creators or influencers earning income through online activity.

Crypto is a digital currency secured by cryptography on decentralised networks using blockchain technology and has continued to gain popularity globally in recent years. Examples include Bitcoin and Binance, which are mostly used to preserve savings, pay for goods and services internationally, and make remittances.

In Kenya, the government has put in measures to regulate the sector by introducing proposals requiring cryptocurrency firms operating in the country to set up local offices and appoint directors subject to approval by a regulatory body such as the Capital Markets Authority (CMA).

Furthermore, the Kenya Revenue Authority (KRA) has also revealed its plan to introduce a new tax system integrating real-time crypto transaction monitoring. This is meant to help them tap into and catch tax cheats and criminals in the local crypto sector.