Bankers seek PAYE reforms setting tax-free salary at Sh30,000

Under a proposal by the Kenya Bankers Association income between KES30,001 and KES50,000 should be taxed at 15 percent.

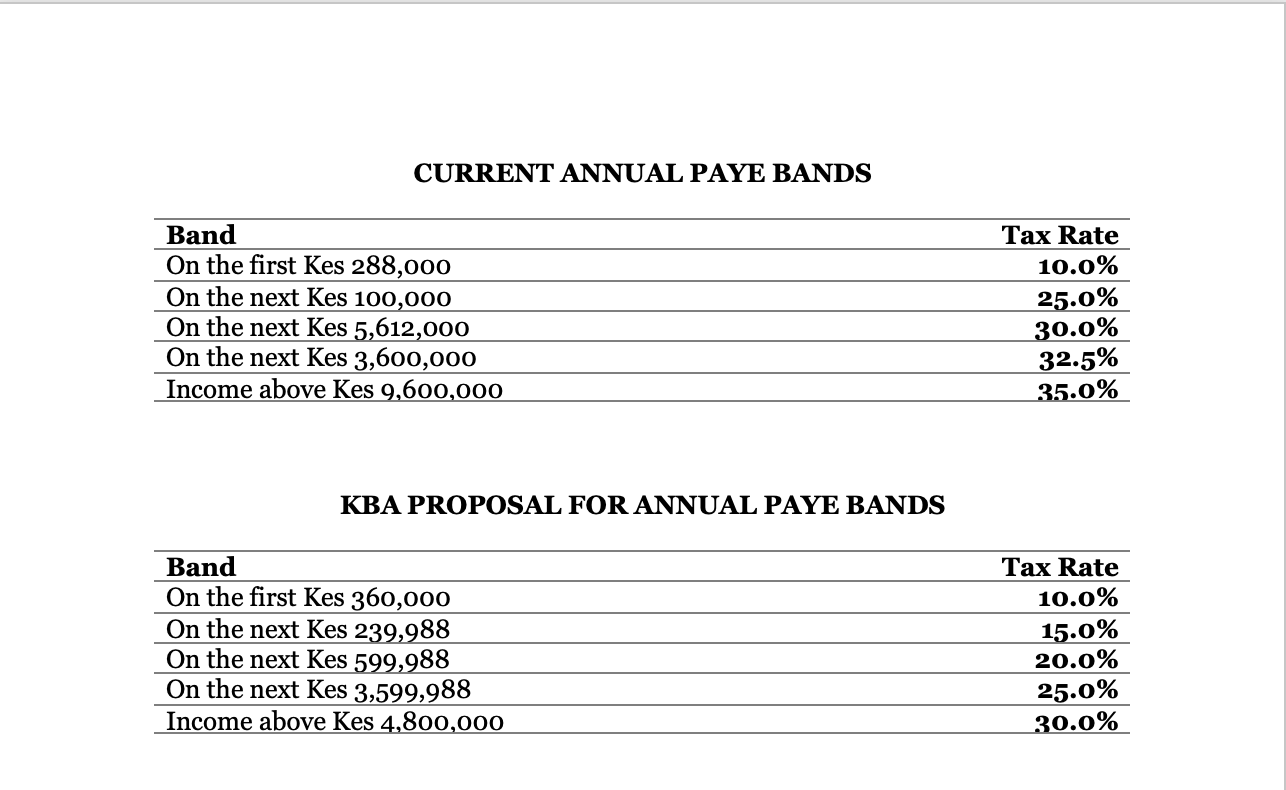

The Kenya Bankers Association (KBA) is proposing an overhaul of the current Pay As You Earn (PAYE) model with a view to increase employees' tax-free income limit from the current KES24,000 to KES30,000 while retaining the top rate cap at 30 percent.

According to KBA, the proposal aims to significantly boost disposable income for millions of workers while also offering support to players in the MSMEs sector.

Under the proposal, which has come out as the Treasury prepares the Finance Bill 2026, the bankers suggest that income between KES30,001 and KES50,000 be taxed at 15 percent.

Employees receiving between KES50,001 and KES100,000 per month will be taxed at 20 percent according to KBA while those getting income between KES100,001 and KES400,000 will see their salaries deducted PAYE at 25 percent. Any income above KES400,000 will be taxed at 30 percent, KBA notes.

Purchasing power fallen

“The purchasing power of salaried Kenyans has fallen significantly in recent years. Adjusting PAYE bands is a practical step to restore household income, stimulate spending, and support businesses,” said KBA CEO Raimond Molenje.

Mr Molenje adding that when workers take home more pay, they spend more, save more, and invest more, strengthening the economy, improving loan repayment, and ultimately growing government revenue.

KBA's proposal also recommends easing Withholding Tax and Withholding VAT remittance timelines, allowing remittance by the 5th day of the month following deduction.

The banking industry lobby holds that this reform on withholding tax would help cut compliance costs, improve the cash flow position for businesses, and encourage formalisation and adoption of digital payments.

At the moment, the PAYE rates under the Finance Act 2023 are: 10 percent on the first KES24,000; 25 percent on the next KES8,333; 30 percent on the next KES467,667; 32.5 percent on the next KES 300,000; and 35 percent on income above KES800,000.

Employees have to further shoulder additional deductions, including the 1.5 percent Affordable Housing Levy, 2.75 percent Social Health Insurance Fund contribution, and rising NSSF contributions.

According to KBA, all these deductions have significantly reduced real wages for workers, which fell by 10.7 percent according to the Parliamentary Budget Office Report 2025.